Distribution utilities are facing unprecedented changes driven by technology breakthroughs and the evolution of the regulatory framework, including ESG. Utility operators must become more agile, adapt their business models to respond quickly to shifting imperatives, build dynamic capital plans with well-mapped optionality, pivot more quickly than competitors, and develop financial acumen that provides shock resistance to shifting markets and adverse weather conditions.

DISRUPTION INDEX SURVEY: ENERGY & POWER

In the most recent AlixPartners Disruption Index survey, based on interviews with 295 energy executives, 94% of leaders expect the utility business model to change within the next 3 years. Energy was ranked among the industries most affected by the disruption in terms of both the magnitude and frequency of change. Among areas of greatest concern, the executives listed supply chain, workforce and digitalization. 74% of Energy executives say the supply chain actions they’re taking are not making enough of an impact. 66% are concerned their company’s employees will not have the skills required to succeed in the future. 77% of leaders believe that the adoption of digital tools is critical to the survival of their company, while 46% say their top digital challenges are poor execution and the workforce not knowing how to use the tools the company has invested in.

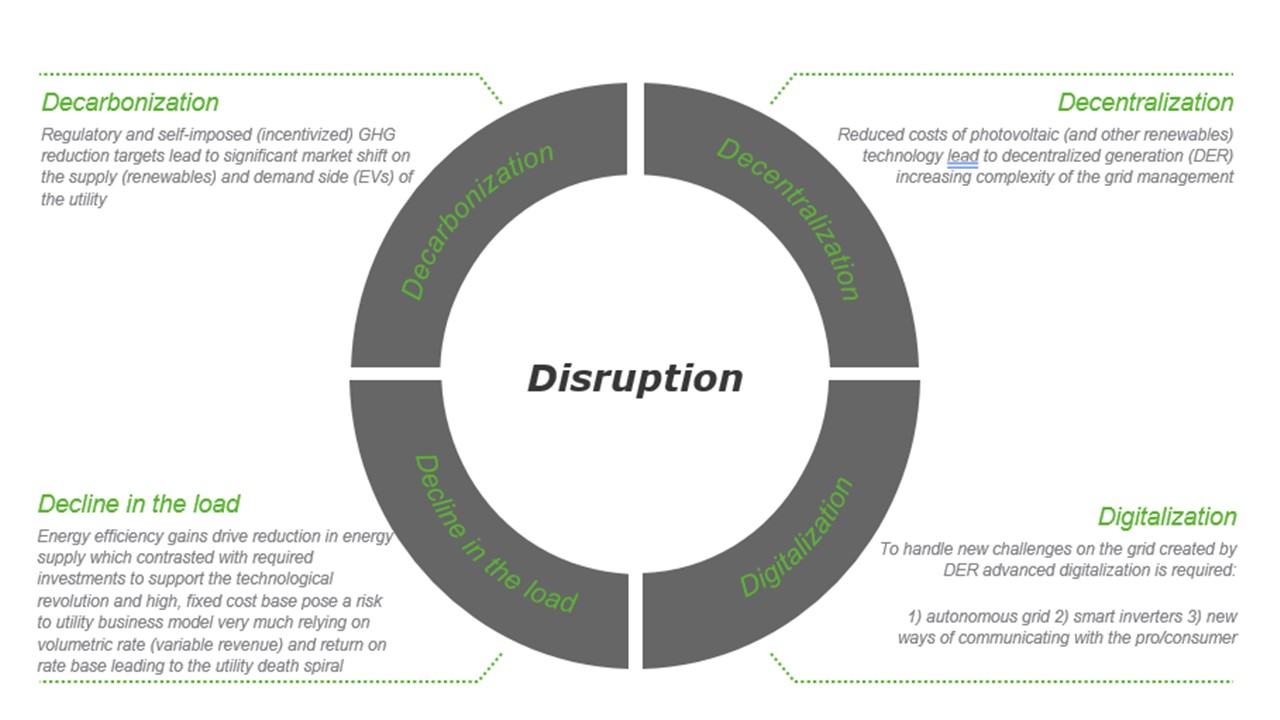

The traditional, stable for decades, monopoly-based business model of a distribution utility is challenged through four external forces: decarbonization, decentralization, digitalization and decline in the load.

The change in response to the external forces may be particularly difficult for utilities. While utilities have historically been rewarded for delivering affordable and reliable electricity, the monopoly-type marketplace has promoted the following practices:

- High sunk costs invested in the legacy assets often at the expense of high leverage

- Technical expertise developed in operating legacy and traditional assets efficiently

- Strongly regulated environment with strict safety and reliability rules driving high fixed operational costs

- Cost of service rate-making promoting extensive capital investments in traditional assets and not reimbursing for development of new offerings (“resource deepening”)

In the past, the high asset base was perceived by utilities as a barrier to entry for a competitor, but in the environment of rapidly evolving technologies and declining unit costs, the high asset base becomes an anchor weighing down growth.

To enable the transition, utility leaders must ask three strategic, business model defining questions:

- What value does and will the company bring to the market?

- Who is and will be the consumer?

- How is and will value be captured for shareholders?

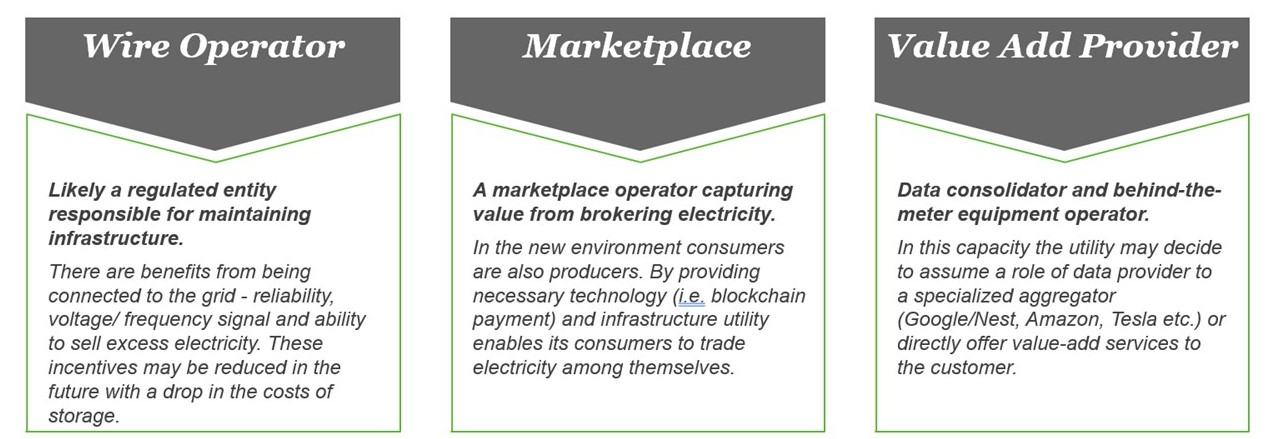

The linear pipe business model focused on throughput and electricity consumed will likely stop existing in today's form. The distribution utility is inherently moving away from a single-sided business model toward a marketplace platform such as Amazon or eBay. The value proposition is a two-fold question about 1) what value the utility will deliver through the platform and 2) to what extent the leadership feels comfortable expanding beyond the regulated market.

Traditionally, the consumer of the distribution utility was the “rate payer.” It was to a large extent a non-personalized relationship with limited brand recognition. Given paradigm shifts, the consumer now evolves to prosumer, who consumes and produces electricity depending on the time of a day/year. In the immediate future, the relationship with prosumer may expand even further and include such services as vehicle-to-grid (V2G), storage and active supply/demand management (e.g. smart inverter, smart meter/ time of use tariffs, active management of appliances for a fee). In an enhanced interaction environment, a utility may want to decide if 1) a direct relationship with the consumer is optimal or 2) acting through an aggregator is preferable. In either case, today’s utility must develop new capabilities to communicate and interact with its clients.

The sustainability of the traditional “cost of service” rate-making method comes into question as market changes require utilities to make extensive capex investments, such as smart grids, transmission interconnectors, renewable energy generation, storage, and digital tools. The volumetric-based variable revenue generation approach is based on set rate of return on invested capital, and that does not correspond with the new reality of decreasing load, high fixed cost base and decentralized capex. Cost of services offered to DER (e.g. reliability, access to the market and voltage/ frequency signal) remains, to a large extent, spread among a shrinking base of traditional utility consumers, affecting affordability while not creating incremental value to the utility shareholders. Performance-based ratemaking along with alternative tariff solutions, such as minimum bill or network access fees, should be explored to address the challenges utilities face to create a sustainable business model.

The financial performance of the utilities will largely depend on strategic business model selection decisions. Decisions related to company positioning on the value chain must be consistent with company’s capex plan and assume building new capabilities to deliver on commitments made to the shareholders. For the first time since the nineteenth century, electric utility leaders face three simultaneous hurdles: 1) technological revolution, 2) expanding regulation and 3) challenges to the traditional economics in the underlying the business model.

---

AlixPartners is a results-driven global consulting firm that specializes in helping businesses address their most complex and critical challenges. Our extensive and unique experience includes leading, in partnership with company executives, large transformation projects -- both strategically and operationally -- for utilities. When It Really Matters.