All eyes in the power industry are on Washington looking for clues about the details of the Manchin-Schumer deal regarding carbon credits. If these credits increase to $85/ton, then carbon capture utilization and storage (CCUS) could emerge as one of the most viable and economic options to help the United States jump start carbon reduction goals.

With the Inflation Reduction Act of 2022’s likely passage through Congress and enabling $433 billion in new investments, predominantly in climate change and energy production, we may see a dramatic increase in the pool of economically viable CCUS projects in the United States.

Three main technologies of carbon capture

Source: National Energy Technology Laboratory, Office of Fossil Energy and Carbon Management, AlixPartners Analysis

Several factors impact economic viability of a carbon capture installation.

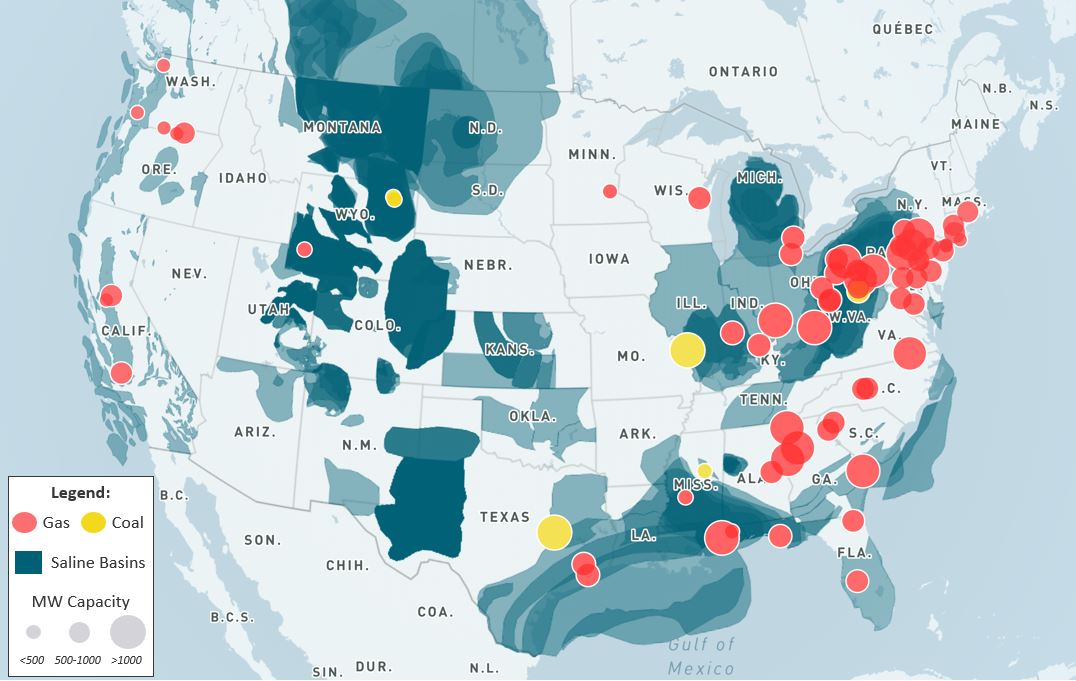

The high costs and technological complexity of transportation of carbon dioxide require CCUS projects to be in direct proximity of storage or point of use, preferably in 25 miles radius. The US Department of Energy is analyzing underground formations for carbon storage, including saline aquifers, depleted oil and natural gas reservoirs, unmineable coal seams, basalts, and organic-rich shales. Some of the best natural storage opportunities are found in saline formations. They are largely dispersed throughout the country with the best opportunities being found in the Midwest, the Rocky Mountains, the Permian Basin, and the Gulf Coast.

Currently AlixPartners estimates cost of post-combustion carbon capture in the range of $55 and $65/t including operating, maintenance, and depreciation expenses(1). Mid-stream and storage add incremental $10 to $15/t, with saltwater aquifers being the most attractive storage option and large-scale operations having lower costs. Layering costs of capturing, transporting, and storing we estimate the all-in cost in the range $65 to $80/t. The current inflationary environment creates additional upward pressure to these estimates.

For the power sector specifically, several additional aspects must be considered such as size, capacity factor and remaining useful life of the power plant. In the map below we visualized potential CCUS installation in the power sector by plotting U.S. natural gas and coal power plants with nameplate capacities above 50MW, commercial operation start date after 2000, and capacity factors above 70%, on top of saline basin formations.

Potential CCUS installations in the power sector

Source: S&P Capital IQ, National Energy Technology Laboratory, AlixPartners Analysis

In addition to lowering the initial cost through optimal choice of location, technology and cost sharing in the hub, a value stacking strategy may significantly improve return on invested capital.

The most widely accessible revenue stream is the 12-year fixed term 45Q Tax Credit that under present law offers by 2026 $50/t of CO2 geologically stored. Some bills have proposed increasing the tax credits to $85/t. This increased incentive could result in a significantly larger portfolio of CCUS projects.

United States 45Q tax credits per metric ton of carbon captured and stored vs total cost of Operations ($/t)

Source: AlixPartners Analysis

The 45Q Tax Credit provides a reduced 2026 incentive of $35/t of CO2 applied to other beneficial uses including enhanced oil recovery (EOR). EOR currently accounts for about 90% of all CO2 usage, but EOR is in the cross hairs of most ESG advocates so it will be interesting to see if credits for this use are increased. Additionally, there is a growing market of CO2 use in other industries such as beverage and food which could expand with higher credit values.

On top of the federal tax credit, state level incentives exist. States within the Regional Greenhouse Gas Initiative (RGGI), centered around the mid-Atlantic and northeast, have an additional opportunity of cost avoidance. Within the RGGI footprint, carbon captured results in a $14/t emission tax avoidance. These tax credits are also tradable on a secondary market. For example, California created a market for Low Carbon Fuel Standard (LCFS) carbon credits, which has led to increased imports of low carbon ethanol to California.

Under current economics without an increase in carbon credit values, broad adoption of CCUS will be challenging. However, this new bill could lead to significant potential for this technology to serve as a bridge to a decarbonized economy. Capabilities needed for carbon sequestration include midstream development, reservoir expertise, tax equity financing, and potentially PPAs and fuel hedges. It is still unclear who will win this race in this new carbon infrastructure landscape, but certainly the winners will be scouring similar treasure maps to plan their moves, and fossil power plant owners will need to form partnerships if they hope to participate. Is your team ready to navigate this new opportunity at a winning pace?

(1) Estimate based on interview with industry experts; cost of carbon capture varies widely depending on the underlying technology