Esben Christensen

London

AlixPartners’ 2022 Container Shipping Outlook observed that “today’s supply-demand mismatch could flip, possibly beginning as soon as 2023.” It’s looking more and more as if we got that forecast just about right.

The container shipping market is cooling off, and some shippers are beginning to turn the change in temperature to their advantage. Many more shippers, keeping a wary eye on the uncertain intermediate-term outlook for rates, capacity, and service, will likely follow suit before long.

The container shipping industry’s fundamentals looked much different in mid-2020, when limited vessel and infrastructure capacity collided with a sudden resurgence in demand. Shipping rates soared into the stratosphere, on-time reliability deteriorated, and container ship operators prospered mightily. But as our report pointed out, the imbalance couldn’t last indefinitely.

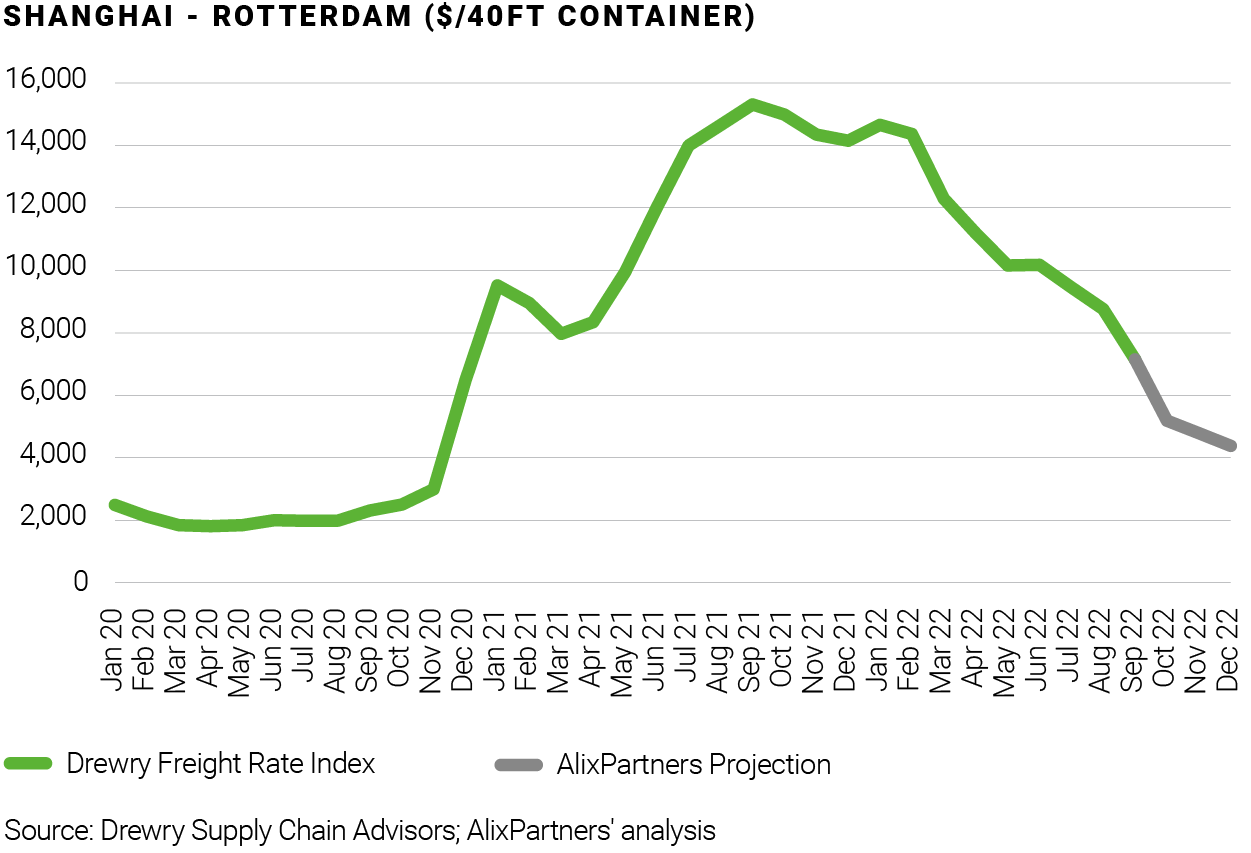

In fact, it may be coming to an end. Seaborne trade is trending downward. Prices for newbuilds are slipping. Contracting for container space aboard liners is slowing. Rates have fallen sharply in the second half and may have yet to touch bottom (see Figure 1). And the scarcity of container capacity is giving way to a glut.

A prolonged supply-demand inversion would have serious implications for liner operators. Their profitability is not imperiled—yet. Although rates are tumbling, they remain well above well above historical averages and the rates prevailing just before the onset of the COVID-19 pandemic. But the precarious economic outlook, an imminent surge in capacity, and rising interest rates and financing costs will put liners under increasing pressure. If shipping rates continue to sink going into 2023, the curtain could finally come down on container operators’ unprecedented run of prosperity.

The consequences of a longer-term rate decline would extend far beyond the liners to stakeholders around the globe, from shipbuilders and port operators to shippers and consumers. Muted demand could ease inflationary pressures, help restore some order to supply networks and allow carriers to lift their on-time performance from the historic depths to which it sank in 2021. Global schedule reliability has been trending upward since the beginning of 2022, reflecting both the clearing of congestion at major port destinations and a decline in demand for container ship space, which is reflected in the downturn in spot shipping rates (see Figure 2).

The falloff in demand may persist for some time. The dollar value of shipping contracts for container space aboard vessels still under construction has trended downward since early 2022, indicating that shippers anticipate a slowdown in their own businesses that will moderate their need for container space (see Figure 3). The financial markets seem to share that view.

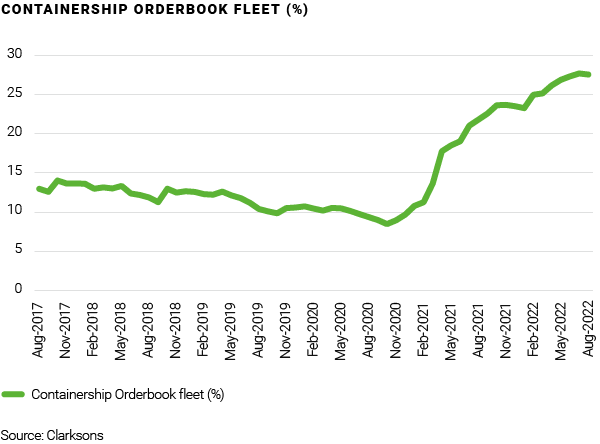

The slowdown in shipping activity is an ominous sign for carriers, which have added nearly 6 million twenty-foot equivalent units (TEUs) of capacity in recent years. Carriers are now starting to take delivery of those newbuilds, and more are on the way (see Figure 4)

Prices for those newbuilds have fallen from their late-2021 peak, and industry insiders report that shipyards have resumed offering discounts (see Figure 5). Carriers, it appears, are having second thoughts about further capacity expansion.

As well they might. Seaborne trade has been on the wane since October 2021, and if the slowdown in global economic activity persists, carriers risk a return to the bad old days of too much tonnage chasing too few goods (see Figure 6).

Senior container liner executives vividly recall the bad times, which helps explain why they drove such hard bargains with shippers while they held the upper hand in pricing negotiations. Now the advantage may be passing to the shippers’ side of the bargaining table. Shippers may soon have a chance to drive some hard bargains of their own.