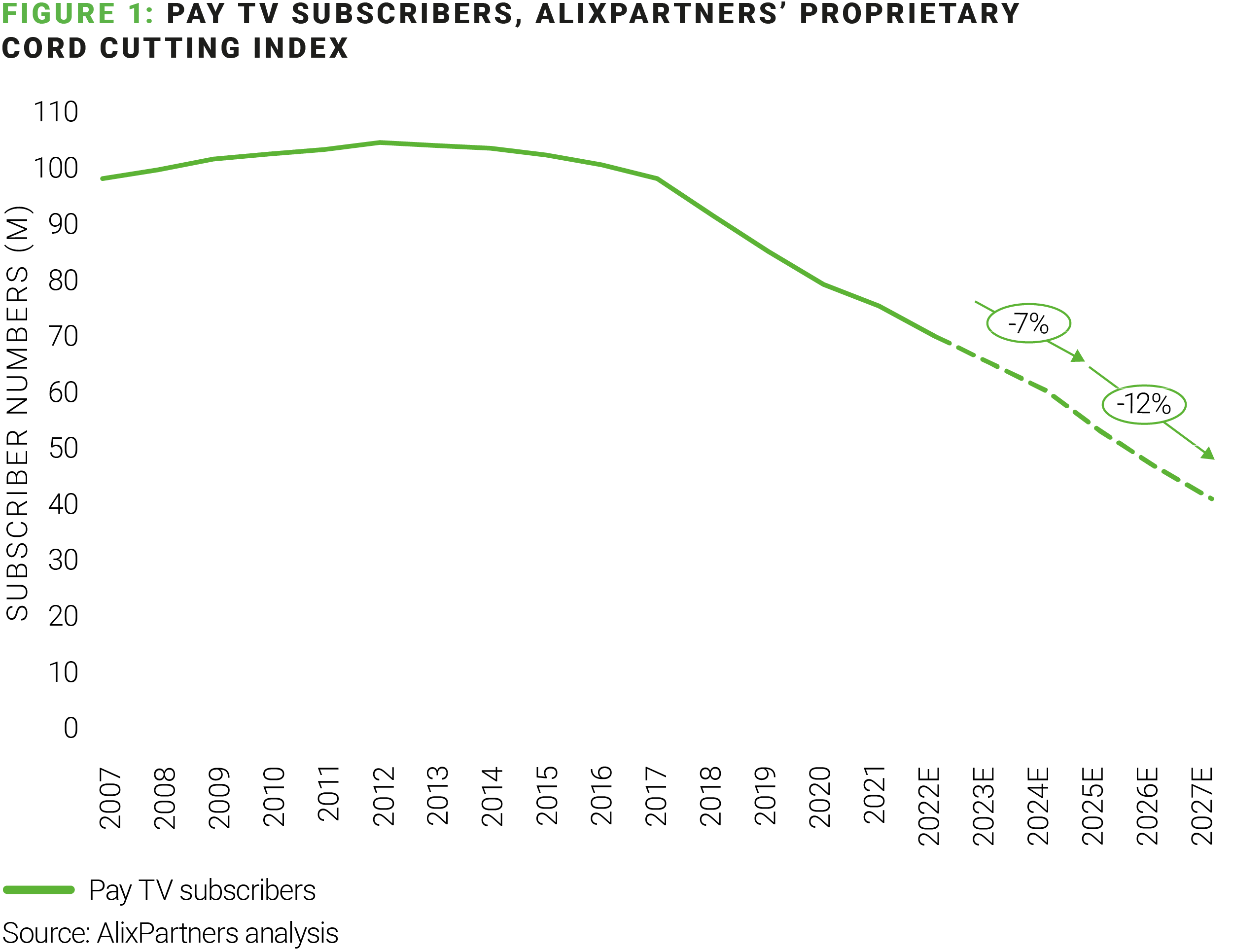

In the latest edition of our series on cutting the cord, we’re diving into a tricky question: Do consumers save money by cord-cutting, or are they paying more for a cordless future than at the peak of pay TV? If so, how do companies compete, given the impending recession leading to consumer spending cutbacks? In our first edition, we introduced our AlixPartners’ proprietary cord-cutting model, forecasting the continued drop-off in pay TV, which we see accelerating over the next five years. Ultimately, this is making Pay TV a declining asset, with streaming the avenue for video content consumption. Our model shows that patterns in cord-cutting seen earlier this year continue (figure 1). But will consumers be better off financially as the streaming universe expands, requiring multiple subscriptions to get the latest and greatest content?

Fewer cords, more costs?

With the acceleration of cord-cutting, households seem willing to pay for multiple streaming services simultaneously, building their own bundle. As a result, customers employ greater flexibility with the services they own and are more willing to churn in and out. In the US, churn rates are growing for subscription video on demand (SVOD) services, with 32 million individuals canceling services in Q3 2022, relative to 8 million in Q3 2019. Even leading SVOD stalwarts like Netflix fear churn as it’s grown by 84% per month since 2019. Given how much content there is and the multitude of approaches to access, consumers feel fewer reasons to stay with a specific service as they can go elsewhere and get quality content.

Major content providers have accelerated spending via development or acquisition primarily to keep customers from leaving their streaming platforms. The top five providers are expected to spend $100B on content across all distribution channels in 2022 alone (figure 2).

The breadth and depth of the content library have become more crucial for retention after using top-ticket, original content to bring net new customers onto the platform.

This shift has created a marketplace for consumers to spend on more platforms and services. Over 60% of US households have three or more over-the-top (OTT) services compared to 20% in 2019. As content creators are all starting their proprietary streaming service in the last 2-3 years, one streaming service is no longer enough, no matter if the consumer’s priority is new hit programming or classic library content.

As a result, viewers and providers are paying more, but neither is getting what they want. Viewers want ownership over their preferred content, while providers want to reduce customer churn and increase the average revenue per user (ARPU).

From subscriber growth to profitability mindset

Success in the early days of streaming services was measured by subscriber growth. As streaming platforms accelerated their growth, they continued to push boundaries on content spending. But the explosive growth of streaming services has created a new challenge: too much market saturation, and companies have been holding premium content on their own platforms instead of licensing to other DTC providers. Netflix globally saw 4% in subscriber growth from Q3 2021-Q3 2022 (from Q3 2020-Q3 2021, it saw 22%); however, in its core North American market, it lost subscribers in Q3 2022. Warner Bros. Discovery shut down its $300 million CNN+ investment one month after launch because it was a sunk cost that wouldn’t sustain subscribers, shifting their strategy.

Now, however, subscriber growth doesn’t tell the whole story. This is partly thanks to the advent of ad-supported video on demand (AVOD) and free ad-supported television (FAST), providers that don’t have monthly fees but instead generate revenue through ads. Providers are also reaching the upper limit of available subscribers thanks to substantial market penetration and the diversification of OTT options.

OTT diversification creates a situation where the Rule of 40 — the notion that a combined growth rate and profit margin of 40%+ is within management’s power — may no longer apply. Instead, providers must work within market conditions to maximize profit and revenue growth. Potential approaches here include higher subscription fees, the creation of tiered services where subscribers pay more for ad-free content, automated back-end solutions, or the addition of value-added services or channels.

The move to personal content packages

The “Metail Economy,” according to AlixPartners Managing Director and Global Retail Co-Lead Joel Bines, is predicated on an economy made up of highly fragmented, individualized, and fluid clusters of customers. Consumer choice and flexibility become critical when interacting with sellers.

While the concept of “metail” focuses on the retail industry, similar issues are central to streaming. Having quality content no longer sets companies apart from their competitors. Instead, streaming services need to recognize a tectonic shift towards consumer choice and control over what they watch. This allows customers to build their own wholly customized content package.

Even though consumers have greater flexibility to build their own bundle, subscription patterns emerge. Our research identified five consumer archetypes within the OTT space (figure 3), each with a unique approach to content and price.

The Casual Surfer

Casual surfers are willing to watch whatever is on via FAST or AVOD and are unwilling to pay for content. They often look to leverage social media to view free content.

The Sets-it and Forgets-it

Set-it and forget-it consumers want ample premium content and availability and will keep their subscription active so long as “something good” is available.

The Sharer

Sharers consume more premium content than they pay for, giving greater flexibility to what is available as multiple people share the cost of subscriptions.

The Value Maximizer

Value maximizers want great content but also want to pay the lowest price. They’re ideal candidates for lower-tier pricing on quality content since they don’t mind ads and are willing to subscribe to premium services for promotional pricing periods to watch a specific show.

The Content Chaser

Content chasers want the newest and greatest content, no matter which provider offers them. In other words, exclusivity and quality quell price sensitivity.

The result is a market trending toward consumer choice and fluidity, building “me” bundles centered on their personal price sensitivity, content quality, and availability. From traditional services that now include streaming options to bundled services available directly from providers, the OTT landscape is starting to look like cable – just without cords.

Pinpointing profit opportunities

How do OTT providers pinpoint profit opportunities in this evolving market? A three-step approach can help.

- Decide on a Direction – Determine if your company is a developer or distributor of content. Is the plan to purchase more content, acquire competitors, or sell content libraries to other providers?

- Optimize Operations – Next, providers must optimize operations to help boost profitability and enhance the customer experience. This means finding cost-effective third-party vendors, leveraging enterprise cloud solutions to ensure high-quality viewing experiences, and creating self-service processes that empower customer choice.

- Find the Right Partner to Build a Content Library – Streaming services need to build out their content library fast to minimize churn and optimize to the archetypes. Partnerships and acquisitions will be crucial to provide compelling content required to stay ahead of the pack.

Bottom line? Consumers are happy to cut the cord but won’t spend more on content they don’t care about. Providers must prioritize ARPU over subscriber growth to survive in the new OTT landscape. This means embracing the rise of customer choice to help drive growth and manage profitability.