Jason McDannold

Chicago

The economy has slowed. Many regions and industries are headed for a recession, or at least a downturn—and 35% of executives surveyed by AlixPartners expect a down cycle that lasts three years or more. Inflation is high; interest rates are rising; bubbles are bursting. Uncertainty clouds everything.

So what are you doing about it?

Business-as-usual won’t cut it in unusual times. That’s especially true for technology companies, their leaders, and their investors, because when it comes to disruption, technology is both a driver and a passenger—the cause of change in their clients’ business, but also an industry that disrupts itself again and again. More than that: As recent stock market performance shows, tech companies are far from immune to the business cycle; indeed, when AlixPartners asked 3,000 executives how they feel about their company’s prospects in a recession, leaders of tech companies were more pessimistic than any industry group except retailers.

Whether they’re selling services, software, or hardware, technology companies must act quickly to protect value and to get in position to grow value rapidly when the economy turns back up or when an opportunity arises. In a recent Harvard Business Review article, Simon Freakley, CEO of AlixPartners, and Lisa Donahue, the firm’s co-head of North America and Asia, outlined a four-part approach to recession readiness: Tune up financial warning systems; maximize cash generation; use scenarios to discover and create options—scenarios; and act. We’ve developed some of the implications of this thinking—and action items—in workshops with technology companies.

Visibility is the first step in recession readiness. You can’t cope with volatility if you see it too late. But most companies’ warning systems are slow and spotty. Business units’ monthly and quarterly reviews with senior management tend to spend more time examining performance-to-date than looking at leading indicators; they want hard numbers, not weak signals. It’s also very common to review business units on the P&L alone, leaving cash flow and balance sheet issues for higher-ups to consider. The result: Early warnings of shifts in demand and supply are often overlooked. A late payment here, a reduced order there—the indications might be small and scattered, and it might be weeks or months before they roll up from product lines, business units, or regions to the senior executive team. For managers, “Let’s watch it for another month” is a natural response to inconclusive but worrisome signs. But value can vanish fast, especially when a downturn is accompanied by other disruptive forces such as accelerating technological change or unexpected supply-chain problems.

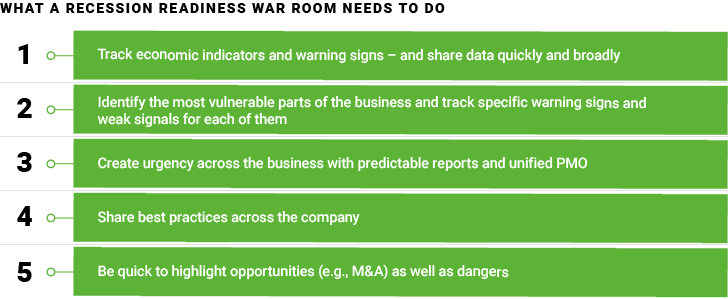

Companies need much better early warning systems and tools to identify signs of distress early and across all levels of business. A good warning system should:

Whether you’re a small organization without a robust financial planning and analysis capability, or a billion-dollar company with a dedicated FP&A department, think about building a “war room” structure to monitor critical and developing scenarios in this recessionary environment. This allows you to have an enterprise-wide view of trends, see patterns, and ensure that executive management can connect income statement, cash flow, and balance sheet views of performance.

This is the first entry in our four-part series about recession-readiness best practices. Watch for part two next week: “Cash: The Key to Resilience.”