Raj Konanahalli

Chicago

Consumers are shopping for shoes less frequently than they did before but continue to be demanding in everything from low pricing to free shipping and frictionless returns to latest styles.

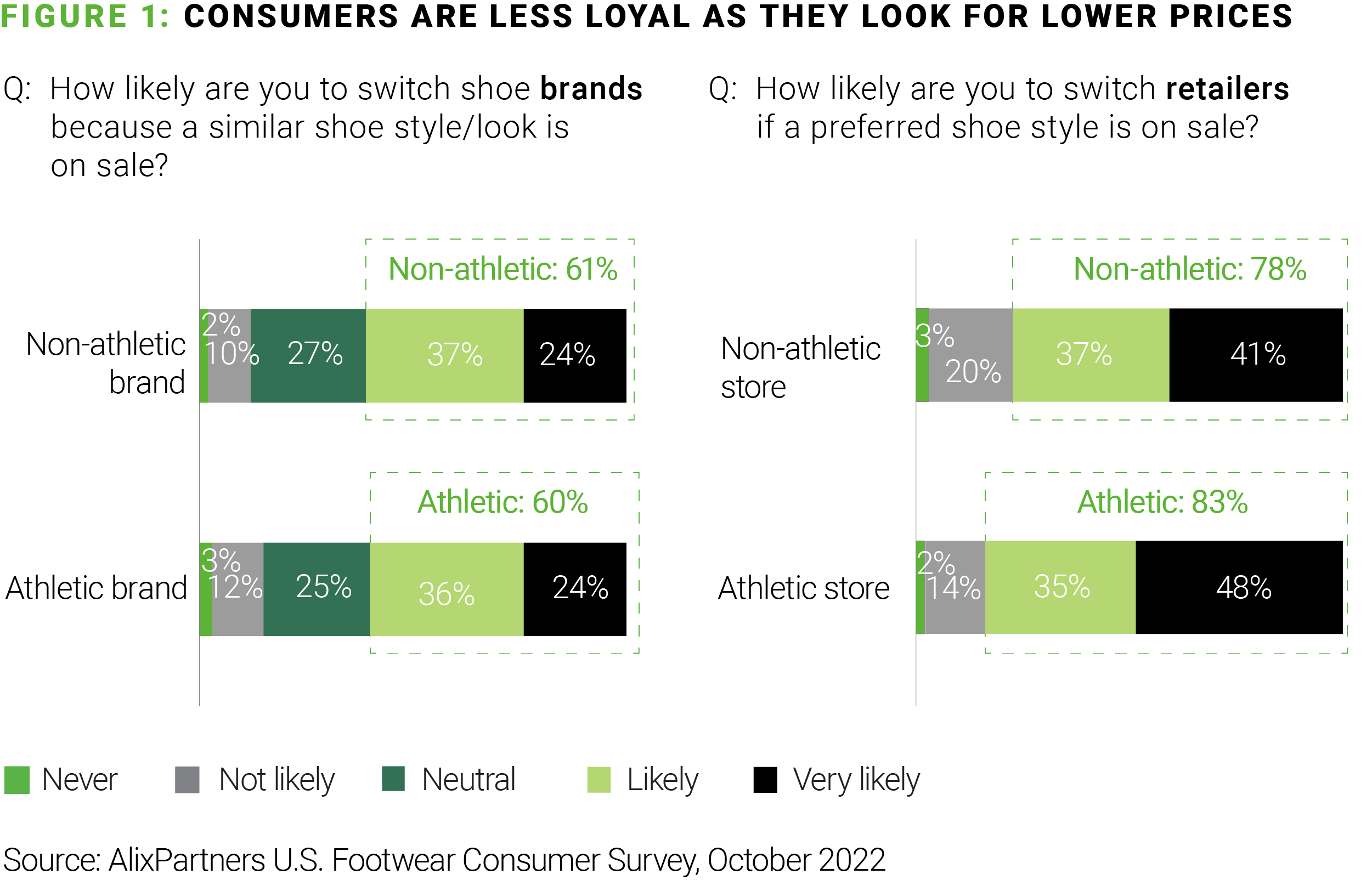

Record high inflation over the last few months has prompted consumers to deprioritize shoe purchases and made loyalty a lot harder to come by for footwear brands and stores alike. The 2022 AlixPartners U.S. Consumer Footwear Survey found that 6 in 10 shoe consumers are likely to switch brands in they receive discounted pricing, and 8 in 10 would switch stores.

There are some gender differences. Women are more likely (at 43% of those surveyed) than men (30%) to say that they have deprioritized shoe purchases altogether. Men are also more likely to pay full price than are women, for both athletic (65% vs. 41%) and non-athletic footwear (56% vs. 36%). While 51% of men said they had spent more than $75 on their last pair of athletic shoes, only 33% of women had spent that much. Women were also slightly more likely than men to switch stores for a sale (85% vs. 81%).

This ongoing pragmatism demonstrates how the digital-first consumer mindset has permeated the post-pandemic brick-and-mortar arena. While 77% of consumers are back to in-store shoe shopping, they have brought along the once-online priorities of price and style with them.

Having given up the bells and whistles of in-store interactions during the pandemic, customers expect a frictionless experience online: 89% of those surveyed expect free shipping and free returns when buying shoes. Baked into the online experience is an assumption of inventory availability that was not guaranteed during the worst of supply-chain disruptions.

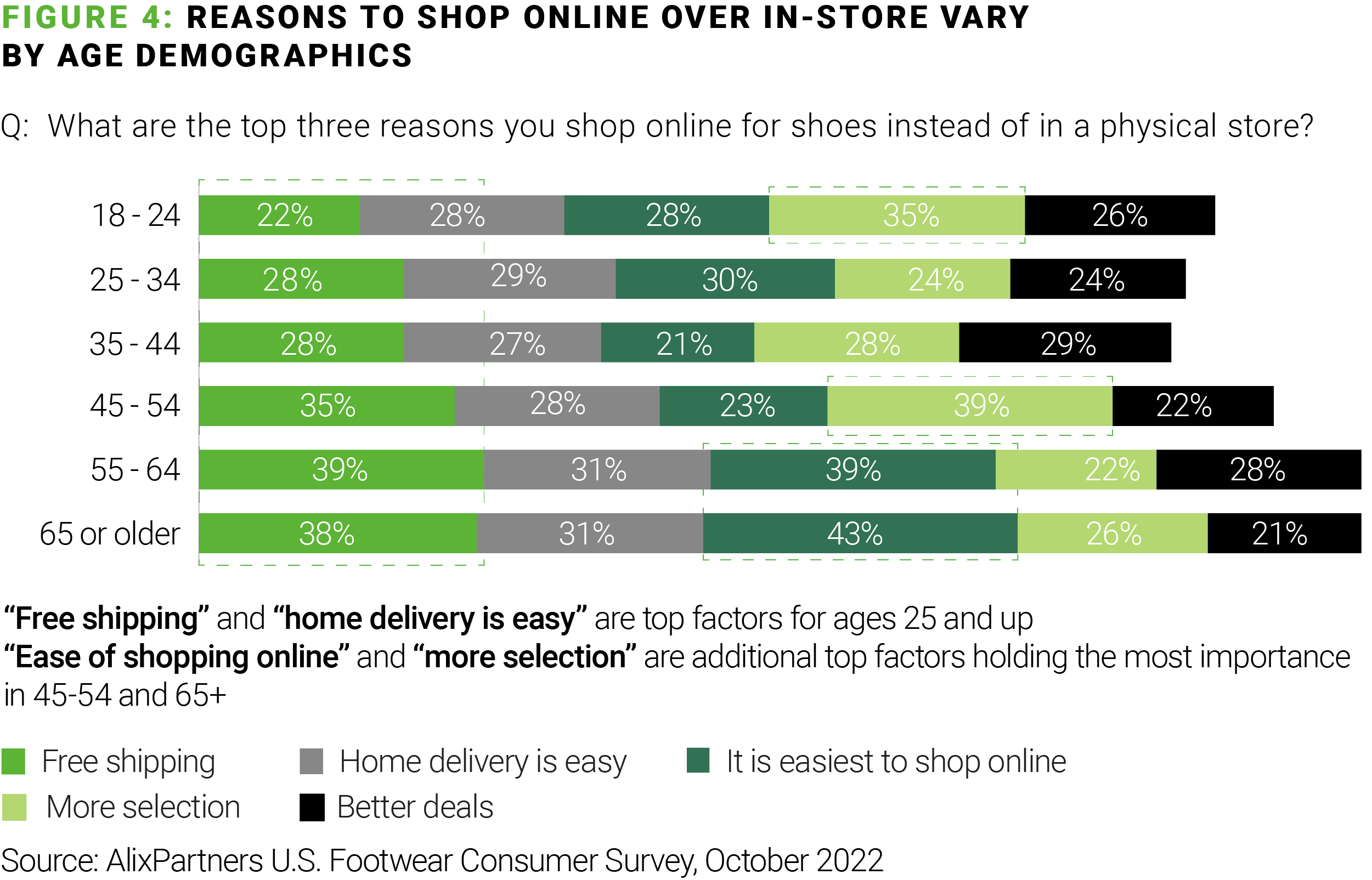

Drivers vary by age, however. Where 35% of people aged 18 to 24 and 39% of people aged 45-54 were most motivated to shop online by the wide inventory available, this was much less important to people aged 55 and up, for whom ease of purchasing and free shipping were the two top factors. Price was a greater factor for older consumers, even though they have greater spending power.

For those shopping in-store, better fit and comfort (49% and 47%) were the top reasons; online, price and style (39% and 34%) lure them away from the big names.

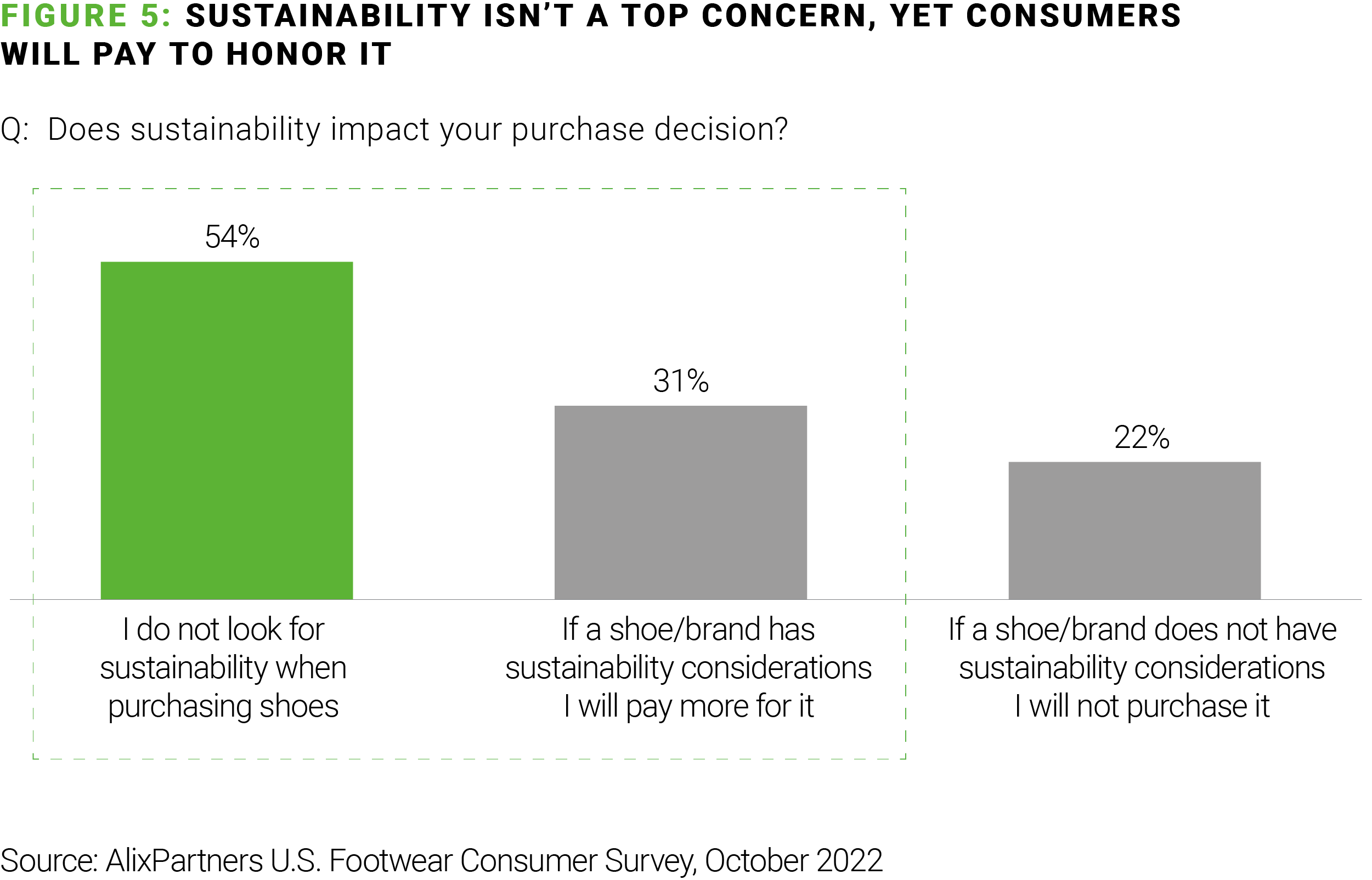

We also saw a small effect from so-called “sustainability considerations” in the design and manufacture of the shoe. While 54% of consumers say sustainability doesn’t impact their purchase decision, 31% are willing to pay more for a sustainable product. This is reflected in moves by big players like Reebok, which launched a vegan shoe line in concert with National Geographic in October 2022.

So, what determines brand and retailer loyalty in footwear today? And how can companies adapt operations to capture — or recapture — their base while staying profitable? Below are a few suggestions:

Adopt a digital-first approach, just like your customers: Retailers and footwear companies need a digital-first mindset given that most retail transactions start online and how reliant consumers have become on researching products online before buying. This shift in mindset resets how the organization should think about everything from customer acquisition and customer lifetime value to the relationship between marketing and sales and where the buying team sits and to whom it reports.

Take a hard look at your product assortment: Footwear brands and retailers need to adapt to evolving consumer preferences, including potentially adding new categories. For example, surging demand during the pandemic opened the category of athleisure footwear, leading to both new emergers in the space as well as competition from existing retailers and brands moving across categories.

Develop and execute on a rigorous operational strategy: Footwear companies need to inject more agility and cost control into their operations given the current economic environment -- and demand that their supply chains do the same, all the way from more accurately creating designs that sell to understanding where best to position inventory to increase sell-through. This will be possible when information and insights flow back and forth between retailers and their suppliers. Productivity is the key to maintaining and enhancing margins.

There is a lot that goes into the perfect fit. Today’s customer wants a competitive price point, a wide selection of options, and a frictionless purchasing experience, but also style and comfort. It’s a high-wire walk, but the $859 billion global industry sector is projected to continue robust growth into 2023, which means there are ample opportunities for those willing to make changes.