Patrick Anglin

New York

Whether you are an online-only retailer or have many stores, your digital presence is likely your single largest entry point to your brand. In-person human interactions remain important, but our constant connection to our devices has forever changed how we discover, research, buy, and use products and services. However, this constant chase for new customers and individual transactions can be draining on profits as customer acquisition costs are at all-time highs.

At the same time, policies and customer expectations continue to change around how information is collected and how customers are identified across their journeys. Establishing trusted and relevant relationships with customers as they share and manage their information is more important than ever.

Retailers must figure out how these digitally enabled interactions, which contribute a lion’s share of influence and transactions in today’s omnichannel world, can contribute to profitability – the single most important metric this year.

More than 70% of consumers told us they read a product review online before buying an item, and 66% do a price check. Forrester estimates that 61% of all U.S. sales are now influenced by digital experiences, and that 70% of all sales will be digitally influenced by 2027. The consumer has very decisively become not just digital forward, but digital first.

But even when they are getting traffic to their site or stores, many retailers continue to see gaps in conversion and value capture, while the customer experience remains suboptimal. Retailers must urgently refresh both their understanding of their customers and how to provide what customers need.

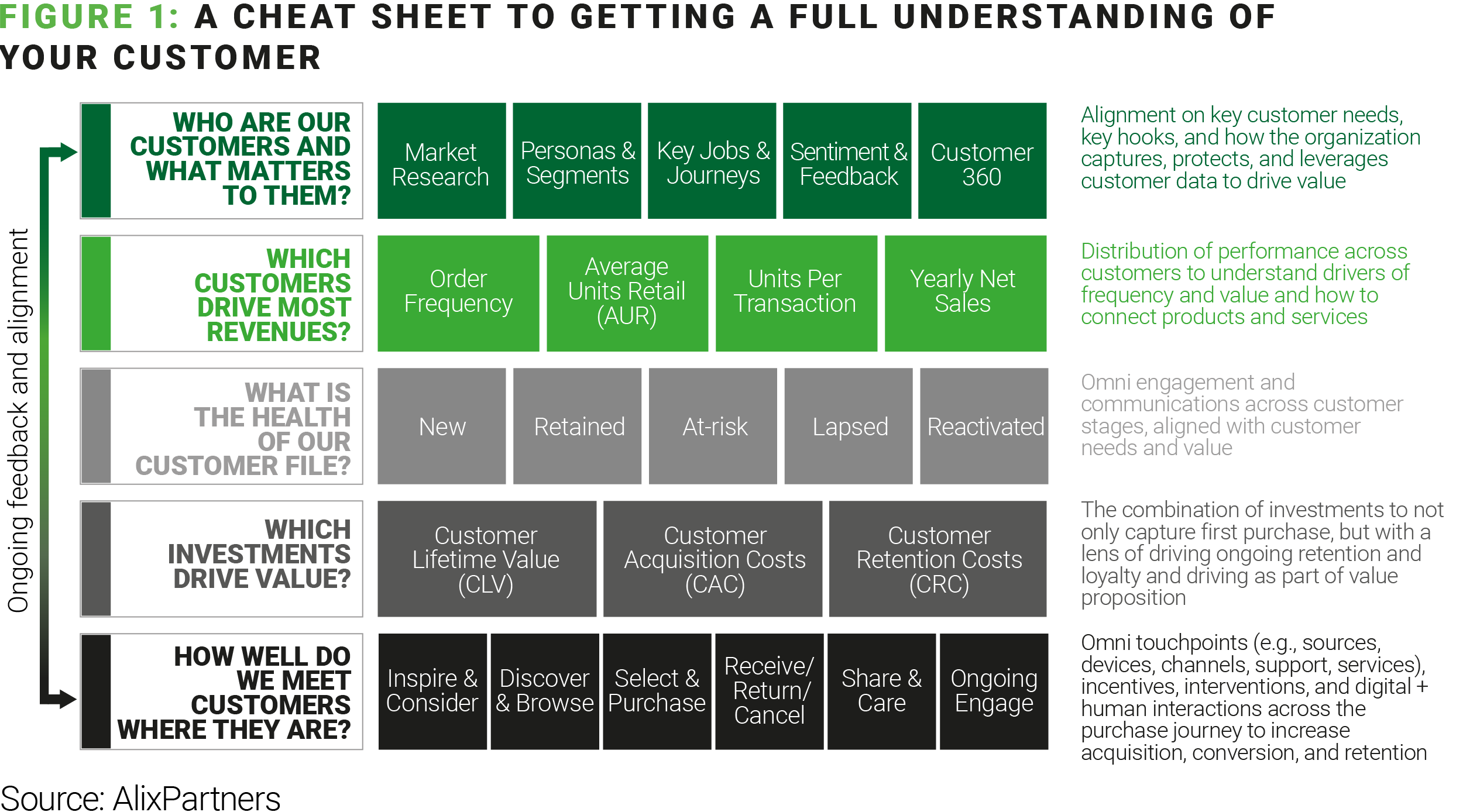

Retailers need to ask themselves the following five interconnected questions to be on a journey to profitable growth:

You’re not only understanding your customers’ prior or existing needs, but also how purchase behaviors are likely to change and identify areas where they may have unknown needs that can be supported in the future. Seek to understand why they are making a purchase, and not just what they are purchasing. An understanding of customers’ product and experience preferences and responses to pricing or promotions tactics is key to bringing them along their engagement journey with a message that resonates and an offer that appeals to them. Determining preferences does not need to be a guessing game. Consumers are increasingly comfortable with companies using relevant personal information (Fig 2). Incorporating these elements into communications often sees two-to-three times improvement in response rates. Equally importantly, all retailers have more customers they have lost than are active at any given point. For the lapsed customer base, a better understanding of their service experience or past shopping behavior can provide vital clues as to the reason they stopped shopping and bring them back into the fold.

While it is mathematically true that you have an average customer, the reality is that your customers perform at a distribution that tells a very different story. For some retailers, a very small percentage may drive a significant portion of revenue, and a very large percentage may be one-and-done customers. It is important to know this distribution and how cohorts are trending over time. It also helps to understand your share of wallet and where you have opportunities to capture more value across customer cohorts. Customers highly engaged with retailers’ owned channels, social media, and blogs often exhibit increased long-term value. Additionally, customers participating in loyalty programs, co-branded/private label credit cards, BOPIS/curbside pickup, and rewards/discounts tend to be more loyal and can generate four to five times the average customer value.

This includes understanding the mix of new and existing customers and if your customers’ value and retention rates are increasing. Having the appropriate omnichannel campaigns and communications approaches for various lifecycle and transactional triggers (e.g., a welcome series, or a series tailored to high-value customers) will help support, retain, and migrate customers as they experience your brand, products, and services. It is also critical to understand your overall ability to contact customers (for example, through email or SMS) and their response rates. If you have the same customer count but your ability to reach them has decreased, you likely have a less engaged customer base and you need to take actions accordingly. Analyzing behaviors, customizing actions for diverse groups, and consistently monitoring and testing contact strategies helps retailers improve their customer file health.

Customer lifetime value must take a multiyear view. While it is widely accepted that it is cheaper to retain a customer versus acquire one, greater clarity is needed regarding the investments necessary to do so. If a customer is worth $1,000 a year versus $100 a year, you would want to make sure you are doing the right thing to keep that $1,000-a-year customer, even if that means spending more to retain them. For example, shipping speed and methods may appear to be a cost, but if better speed and/or quality of service drives greater profitability, it must be considered. Likewise, just having a loyalty program is not sufficient. Retailers must differentiate customers within the program to cultivate true loyalty, otherwise it just becomes a discount program. This can be done by analyzing program member actions such as earning/redeeming rewards, upgrading to credit cards, using multipliers, post-enrollment transactions, and referrals.

This encompasses the full breadth of omnichannel touchpoints and interactions a customer has with your brand, as well as external influences that shape perceptions and purchase decisions. Identify prospects or customers with the largest potential while staying aligned with your overall brand strategy. Understand which customer needs and journeys are most common -- and most valuable. Understand where there are areas of friction and size their impacts. Organize channels and resources to best address these frictions and to orchestrate omnichannel interactions. This includes continuing to optimize efforts across areas such as site speed, logged in and identity management, search and navigation, product page health, cart and checkout, post-purchase fulfillment and returns, as well as overall account and preference management and ongoing feedback. At the same time, do not underestimate the power of positive customer service. Salesforce research found that 96% of customers say excellent customer service builds trust.

The questions above are not mutually exclusive or inherently sequential. You must understand the needs of your customers, how your omnichannel interactions and investments ladder up, and how that drives overall value and profitability. While it sounds challenging, getting the right answers to the above questions is necessary if retailers are to achieve and maintain profitability.

Focusing your teams on the highest value efforts and capturing feedback to refine efforts will go a long way. Both macroeconomic conditions as well as consumer behavior will continue changing rapidly, so being able to sense and respond and take coordinated action is key to success going forward.