Andrew Csicsila

Chicago

The pandemic produced distinct winners and losers across consumer product categories as it upended the choreography of daily life. Overall consumer spending dipped 2-3% in 2020 after growing in 2019 and prior years. That decline, however, concealed windfall spending for goods consumed in and around the home, while travel-related categories were devastated. Government stimulus payments totaling more than $10,000 for many families left consumers flush with cash, boosting demand for goods that in many cases were supply chain constrained. Consumers shifted their expectations by paying more, waiting longer, and tolerating fewer choices as niche SKUs were deprioritized on production lines. How they purchased goods shifted, too, accelerating online.

Just as these spending patterns began normalizing – faster in some categories than others – a new threat emerged. Inflation of up to double-digit percentages in the last 18 months has wiped out more purchasing power than the value of the pandemic stimulus payments, plummeting the University of Michigan Consumer Sentiment Index to 50 in June, its lowest since tracking began in 1952.

Consequent higher interest rates, a culprit in the recent banking crisis, plus economic anxiety over the possibility of stagflation – the vicious combination of stagnating growth, rising unemployment, and rising inflation – have further unnerved consumers and left consumer products companies gauging where demand is heading in their categories.

The state of consumer spending remains precarious, as AlixPartners tracks in its quarterly Consumer Pulse. Household debt rose 2.4% in Q4 2022, as inflation, while tapering, outpaced wage gains. Underscoring the impact these severe peaks and valleys in consumer spending has had on corporations, consumer products was the second-most disrupted category of the 10 tracked in the AlixPartners 2023 Disruption Index among global executives.

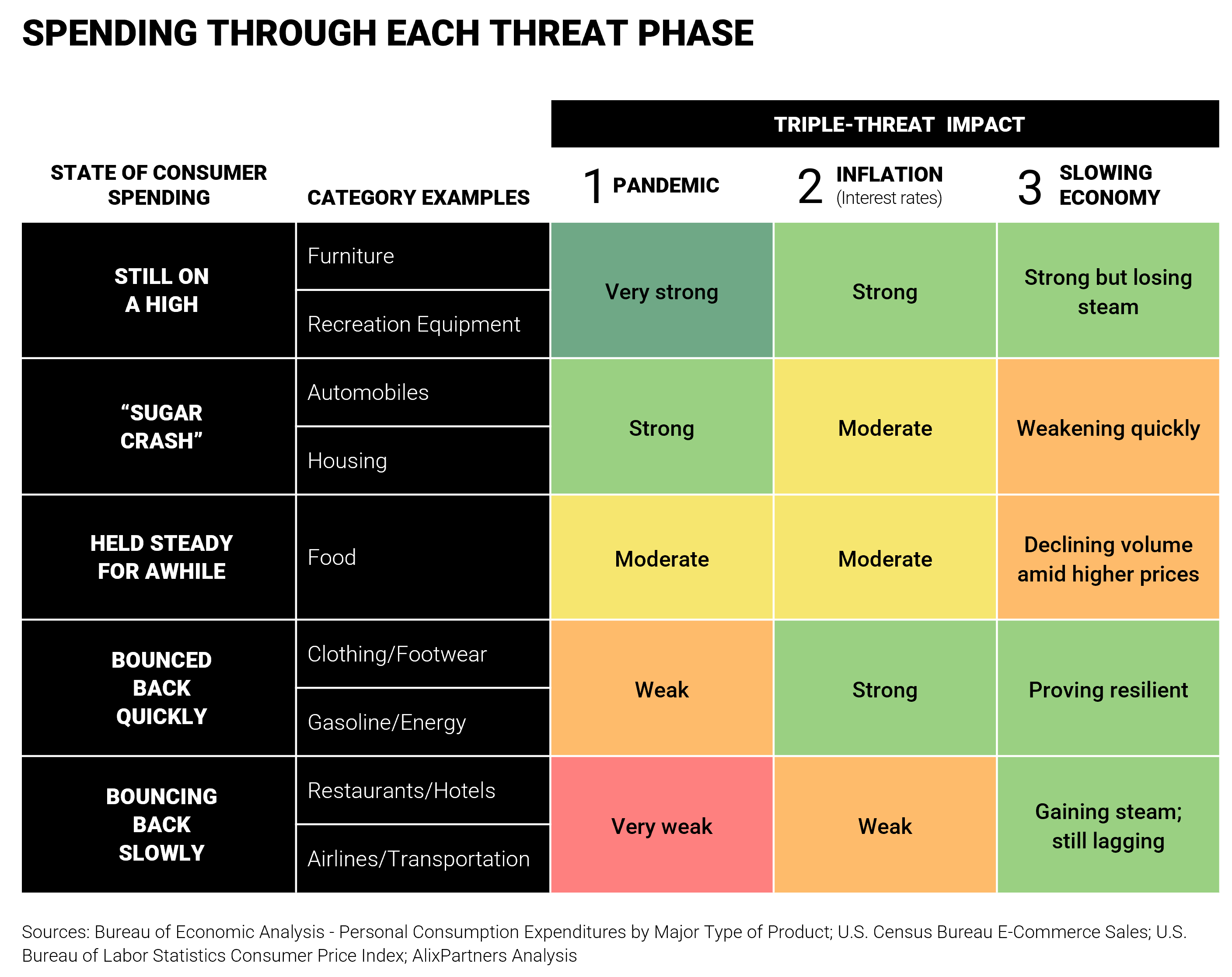

These macroeconomic forces drove swings in shopper spending patterns that vary by category, which in turn can be put into five buckets: those that are still on a high; experiencing a “sugar crash” coming down from their high; held steady for awhile; bounced back quickly; or, bouncing back slowly.

For example, outlays on furniture and recreation equipment have been frothy but are likely to slow to a greater degree than spending on staples like food and clothing, which will see consumers trading down to cheaper options rather than going without. A recession is apt to hit discretionary goods hardest as consumers prioritize necessities. In a fall 2022 AlixPartners survey, 40% of consumers planned to spend less over the holiday period. Private label products will continue to gain strength as shoppers make tradeoffs to stretch limited spending power.

Here’s how we see trends in demand playing out at a category level:

Depending on whether a given category is likely to expand, recede, or hold steady, companies need to implement the right strategies to thread the needle as preferences shift. Understanding how the challenges and priorities change based on each demand scenario is an important first step.

1. Still on a high (furniture and recreation equipment)

Lockdown purchasing behavior in the pandemic elevated spending on consumer durables to 25% higher in 2022 than 2019. As the boom in home renovations and outdoor activities/recreation equipment finally shows sign of receding, firms need to:

2. “Sugar crash” (automobiles and housing)

Strong demand for cars saw inventories dwindle. Housing prices spiked 45% from December 2019 to June 2022 thanks to “pandemic gentrification.” High interest rates have impacted car finance and house mortgage costs, taming demand.

3. Held steady for awhile (food)

Groceries did well amid greater at-home food consumption, but the category met its match in 2022 thanks to lingering double-digit inflation. Going forward, this sector needs to:

4. Bounced back quickly (clothing and footwear, gasoline and energy)

Fashion consumption declined markedly in the early stages of the pandemic as many people worked from home, and demand bounced back as the world opened up. Gas and energy have been impacted by geopolitical conflicts and supply-chain issues, and remain complicated even as some headwinds have abated. Companies facing a quick uptick in suppressed demand should:

5. Bouncing back slowly (restaurants, hotels, airlines)

No sector saw the bottom fall out of demand more than hospitality, with 8 million jobs lost as travel was shut down and people worked from home. Recovery of restaurant and travel segments is a slow, steady affair, historically lagging other sectors. These companies need to:

U.S. consumers have proven remarkably resilient over the years, and even as they confront the triple-threats of pandemic, inflation, and potential recession, it’s unwise to bet against them. That said, their spending habits will likely shift this year, and companies can capitalize on the new landscape of consumption by staying attuned to the dynamics of their respective categories and taking appropriate actions.