Stephen Dyer

Shanghai

China’s government recently published a draft revision of its “Catalogue of Technologies Prohibited and Restricted from Export" and the public feedback period on this revision officially ended earlier this year. It is likely that LiDAR systems will be included in the list of technologies with export restrictions. Given that this is a significant new technology for the automotive industry, AlixPartners conducted an analysis of the potential export ban to provide insights and implications for automotive OEMs and suppliers.

LiDAR technology has become a vital component of Advanced Driver Assistance Systems (ADAS) and autonomous driving solutions as the market shifts to higher levels of intelligence. Chinese LiDAR companies currently hold a prominent position in the global market due to factors such as Chinese customers’ high acceptance of new technologies, the capability of Chinese LiDAR suppliers to work to the unique needs of local Chinese OEMs, and growing economies of scale for these LiDAR players. AlixPartners found that although the technology export ban may impede overseas investment and Chinese LiDAR companies’ global expansion in the medium to long term, short-term sales are unlikely to be affected.

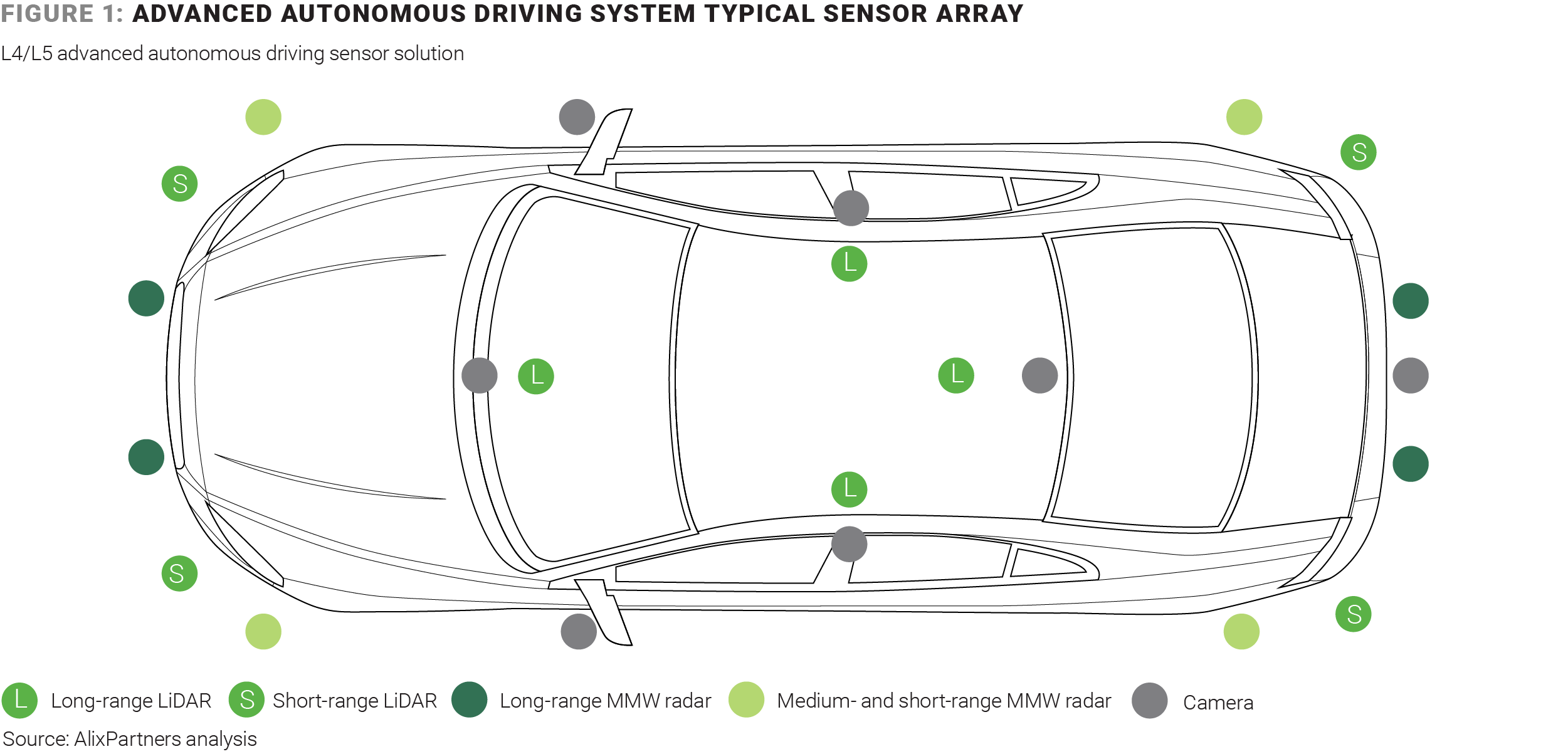

LiDAR is becoming the core component of mainstream autonomous driving solutions

As the auto industry transitions from gasoline to electric care, the Chinese market is transforming more deeply and faster than expected, driven by the increasing demand of new technologies from Chinese consumers. AlixPartners views electrification as the first half of this transition, while the focus for the second half is on achieving higher levels of intelligence, in the form of ADAS and autonomous driving.

Chinese players hold a pivotal position in the LiDAR market

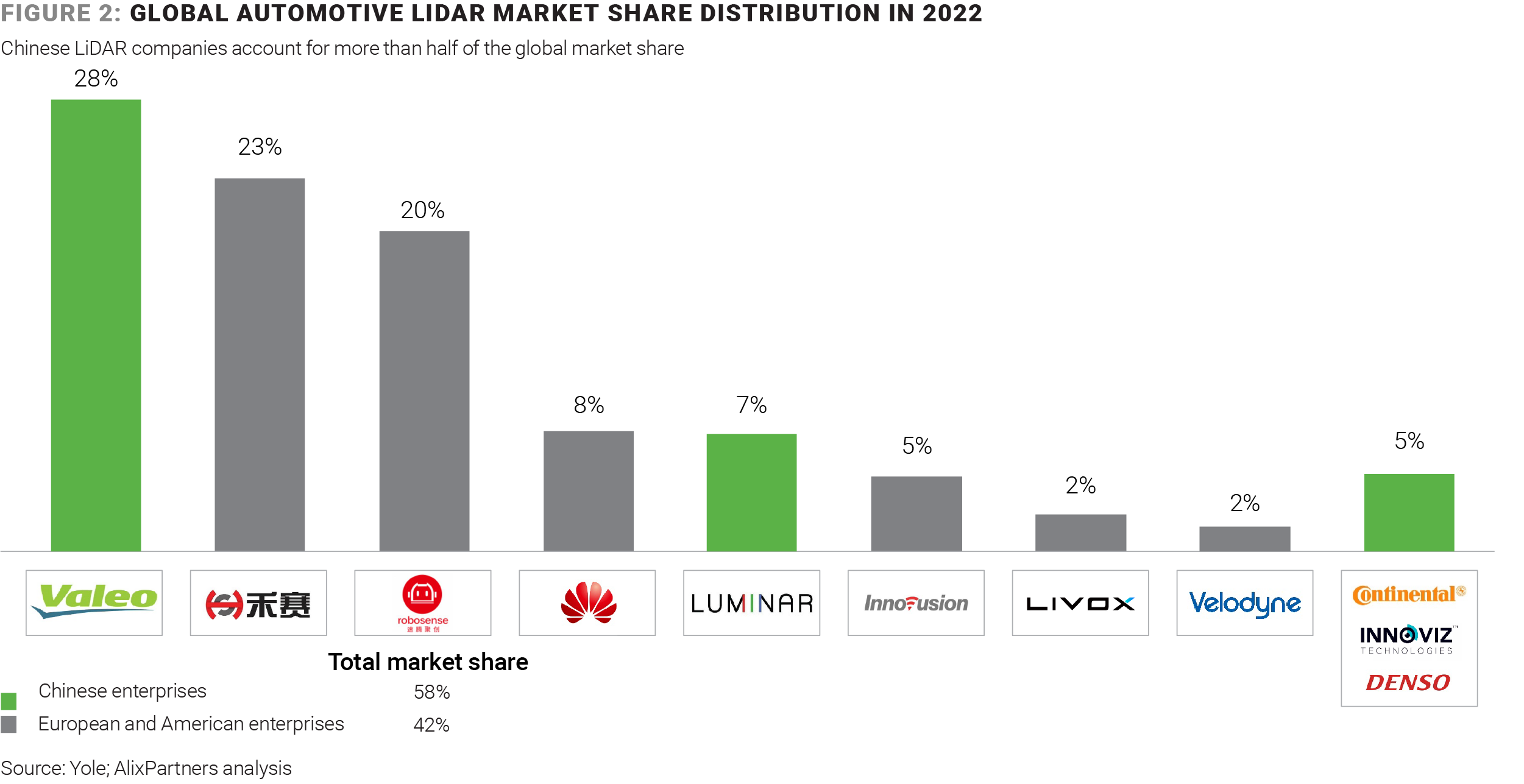

Chinese LiDAR companies hold a significant position in the global market, thanks to the country’s vast domestic market. According to AlixPartners’ 2022 Global Automotive Market Outlook, Chinese companies captured more than 58% of the global market share in the automotive LiDAR segment (Figure 2) in 2022.

The rapid development of the Chinese LiDAR market is primarily due to three factors:

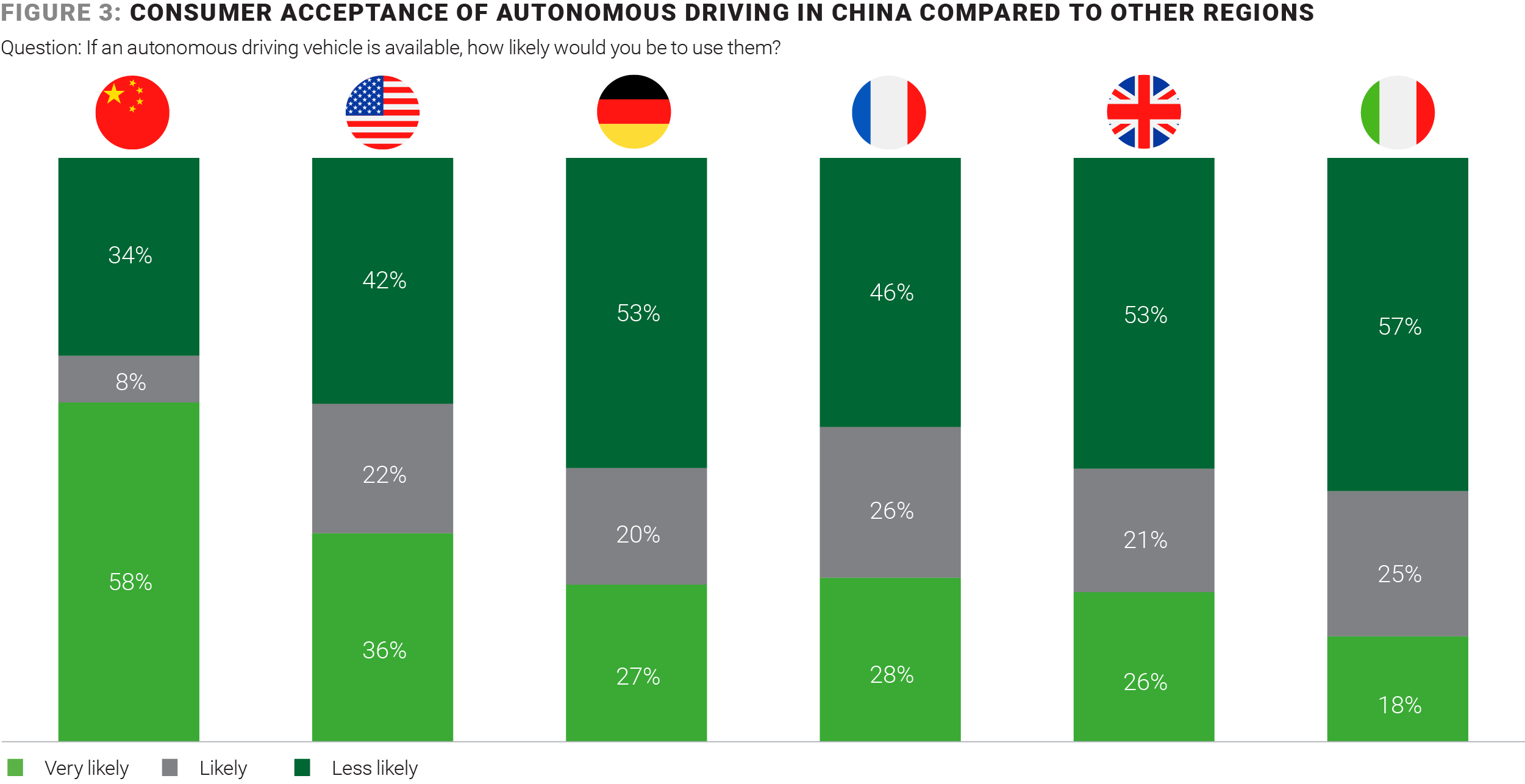

1. Chinese consumers’ high acceptance of new technologies makes Chinese automakers more motivated to differentiate themselves through, and sometimes less proven new technologies. AlixPartners’ 2021 Global ADAS and Autonomous Driving Consumer Survey revealed that Chinese consumers have a higher acceptance of new automotive technologies compared to other regions (Figure 3).

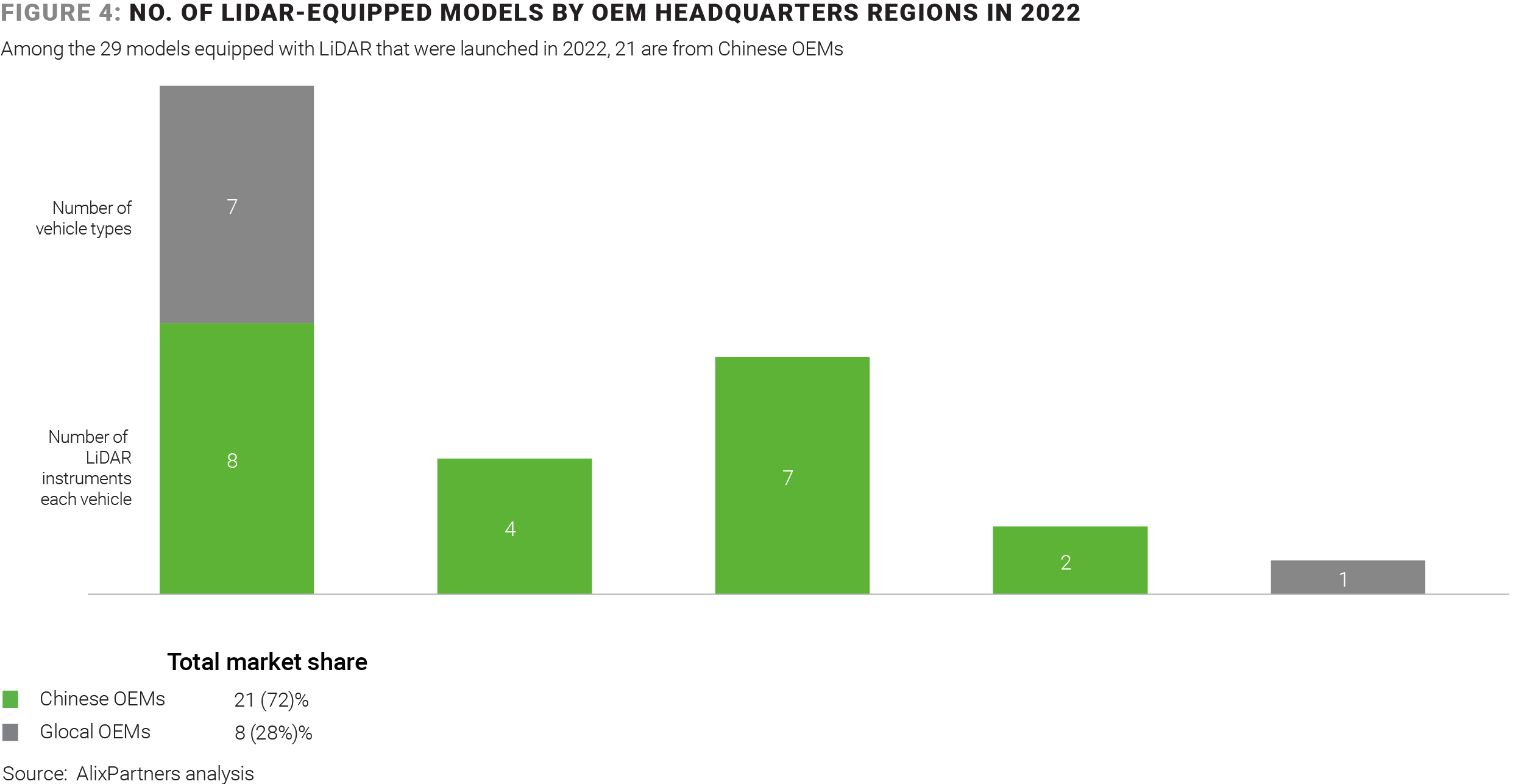

Based on this deep understanding of local consumers, Chinese OEMs, especially EV start-up OEMs (e.g., NIO, Xpeng, Li Auto), have responded rapidly. Many Chinese car brands have begun to seek intelligent features as selling points to differentiate their brands and products, and LiDAR is undoubtedly one of the most attractive add-ons. In 2022, most of the models that were launched globally and equipped with LiDAR were from Chinese brands (Figure 4).

2. Chinese LiDAR companies' fast development support and low price are well-adapted to Chinese OEMs. Chinese LiDAR companies have a faster response to demands in product lifecycle and development. The development time from first prototype to Start of Production (SOP) of mainstream overseas LiDAR manufacturers is more than two years; in contrast, Chinese LiDAR companies have a shorter cycle, which indirectly brings lower prices. Therefore, domestic LiDAR systems have great appeal to Chinese OEMs, especially those in the electric vehicle sector. An AlixPartners survey showed that R&D response time and price are among the most important supplier selection criteria for Chinese OEMs in the ADAS field (Figure 5). This is different from the quality and reliability priorities of non-Chinese OEMs.

3. High demand in China gives Chinese LiDAR companies economies of scale advantages compared to competitors. The 2022 Global Automotive Market Outlook by AlixPartners revealed that the average cost of a single LiDAR is rapidly decreasing with the volume of production (Figure 6). Thanks to the integration of optical module design and economies of scale within China’s industrial chain clusters, Chinese LiDAR players’ cost advantage is increasing. The prospectus of the leading Chinese LiDAR manufacturer, Hesai, shows a gross margin of 44%, far exceeding that of overseas competitors.

We believe that Chinese LiDAR companies have already opened up the path to commercialization and entered a virtuous development cycle. The favorable attitude of Chinese consumers towards new technologies has prompted Chinese automakers to be enthusiastic about mass-producing LiDAR-equipped vehicles. The low price of domestic LiDAR and the support for rapid iteration and development of Chinese automakers have won them a large number of orders, providing scale to further lower costs.

Due to shifting geopolitical factors, many countries have recently begun to impose export controls on key technologies to ensure their leading position. Given China’s LiDAR sector advantages, it is not surprising that technology is listed in the "Catalogue of Technologies Prohibited and Restricted from Export".

The ban on LiDAR technology export will not have a significant impact in the short term, but overseas investment and expansion will be affected to some extent in the medium and long term.

The ban on the export of LiDAR technology is not expected to have an immediate impact on sales of Chinese LiDAR firms. As per the "Regulations of the People's Republic of China on the Administration over Technology Import and Export ":

"Technology export refers to the transfer of technology from the territory of the People's Republic of China to outside of China through trade, investment, or economic and technical cooperation, including patent transfer, patent application transfer, patent implementation license, technology secret transfer, technology service, and other forms of technology transfer. Technology exports are subject to list management, and the competent authority formulates, adjusts, and publishes the list of technologies that are prohibited or restricted from export. Technologies that are prohibited from export cannot be exported, while technologies that are subject to export restrictions are subject to license management, and cannot be exported without a license.”

In summary, the so-called export restrictions restrict technology, not products. From the supply side, as long as there is no technology authorization or transfer involved, we do not believe that the ban on technology exports will directly hinder the overseas sales of Chinese LiDAR enterprises in the short term. From the demand side, global OEMs rely more on leading tier-1 suppliers to integrate ADAS systems. Chinese LiDAR companies are tier-2s, who purely supply products rather than conduct joint technological development, which means their typical business model is not subject to the restrictions of the ban.

However, in the medium and long term, Chinese LiDAR companies may face certain obstacles to overseas expansion. Global OEMs often request suppliers to set up production lines and R&D centers near their factories. If overseas automotive customers make such requests, it may affect the actual ability of Chinese LiDAR players to support this overseas business. Therefore, relevant companies will need to prepare in advance and strengthen communication with government officials to ensure compliance with regulations and approval from regulatory authorities.

Additionally, foreign investment and acquisition opportunities may decrease due to the ban on technology exports. Chinese autonomous driving technology start-ups, especially those related to LiDAR, have been popular targets for foreign in recent years. Due to the existence of the ban on technology exports and the supervision, investment and acquisition may become more complicated, which may lessen foreign investors' interest, thereby affecting the valuation and development of start-ups. Of course, unlike industries that heavily rely on foreign capital, investment in China's automotive industry chain is mostly led by local capital.

Finally, overseas customers may scrutinize their own ADAS supply chain dependency on China. From the perspective of cost and profit, overseas OEMs and tier-1 suppliers undoubtedly want to cooperate with Chinese LiDAR enterprises, but the ban on technology exports may make them re-evaluate the risks of their own supply chain and become more cautious about potential cooperation. It remains to be seen whether this will result in further barriers in technologies and supply chain.

Overall, LiDAR is becoming a key element of both L4+ autonomous driving and L3 and below ADAS systems as its costs go down. Chinese firms are the up-and-coming leaders in market share due to China consumer trends and ability of Chinese suppliers to flexibly and cost-effectively address OEM needs. The Chinese government proposed LiDAR export controls will have little short-term impact, but may lead to longer term effect on overseas investment and expansion.