Frequent, aggressive promotions require significant time and margin investments, but most grocers regard them as indispensable for driving traffic. According to new AlixPartners consumer research, shoppers don’t necessarily share that view, at least when it comes to produce, proteins and prepared foods.

We polled 2,000 consumers on their reasons for choosing a store for fresh food, and less than 10% selected promotions as their top driver. Quality, everyday price, overall value, and convenience of the store ranked higher.

Put simply, fresh promotions aren’t driving store selection enough to warrant the resources devoted to them. Retailers should reexamine their investment in fresh promotional activity and refine their approach.

Evaluation of this activity is especially important when we recognize that a heavily promotional approach to the perimeter can come at a high cost, with increased shrink always a threat if execution at the store level is less than flawless.

Taking a more strategic approach to fresh promotions will go a long way toward increasing the profitability of those departments. Here’s what we recommend.

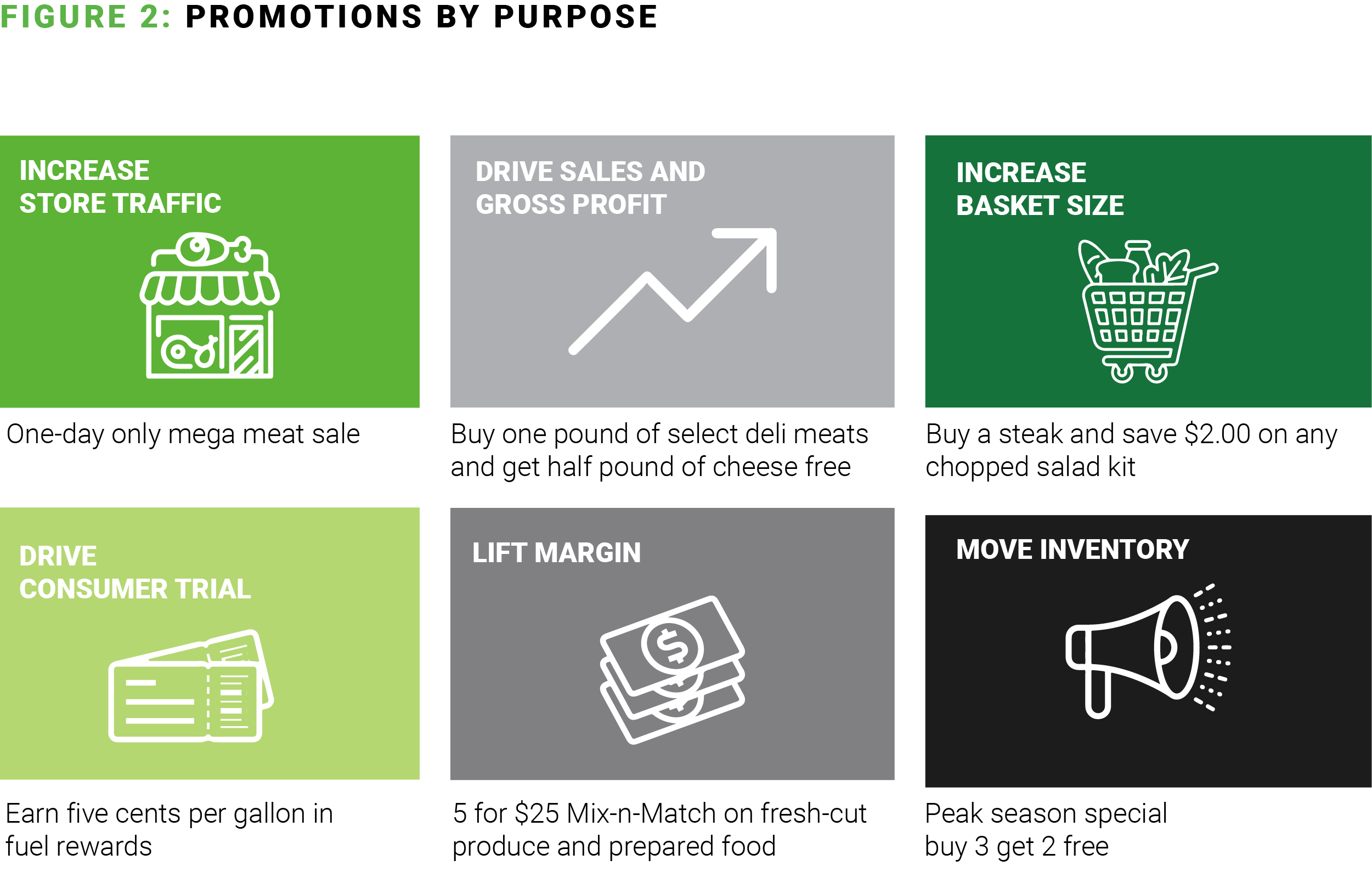

1. Define the purpose behind each promotion.

Just as in the rest of the store, retailers should have a clear intent behind any fresh promotion. Determining pricing, merchandising, and marketing for ad items is a much easier exercise once specific goals are set.

The approach will be different, for example, if the intent is to drive trial of a newer item versus get a lift in traffic. A promotion designed to move excess inventory will be distinct from one geared toward increasing basket size. A promotion intended purely to keep a certain item’s price close to that of a competitor will look different still.

Fresh is unique from other parts of the store in that there are both supply-driven and demand-driven promotions. Demand-driven promotions–think turkey for Thanksgiving, watermelon for Fourth of July, avocados and prepared guacamole for the Super Bowl, etc.–require more advance planning and can serve a larger range of purposes.

Supply-driven promotions generally arise from market opportunities–say there’s a bumper crop of high-quality Texas grapefruit and the abundant volume is depressing prices–and can accomplish other goals, like driving sales or lifting margin. To take advantage of these deals, grocers must develop strong relationships with their suppliers, and they must build flexible processes and prepare stores to handle additional volume on short notice.

Generally, the vast majority of the calendar will be focused on demand-driven promotions, and it behooves retailers to be judicious in that planning and offer their most aggressive prices sparingly. Creating a more flexible corollary strategy for produce in particular, where supply-driven promotion opportunities are most likely to arise, can be a powerful complement to the larger, demand-driven promotional cadence. For either type of fresh promotion, however, determining purpose is a critical first step.

2. Take a tiered approach to promotional pricing.

Less than 10% of survey respondents listed promotions as their main reason for fresh store choice, and only about 15% selected everyday price. That means, conversely, 75% of shoppers base their store choice on factors other than absolute dollars. Even in the current environment of high inflation and increased price consciousness among consumers, grocers have an opportunity to be more conservative when it comes to depth-of-discount decisions.

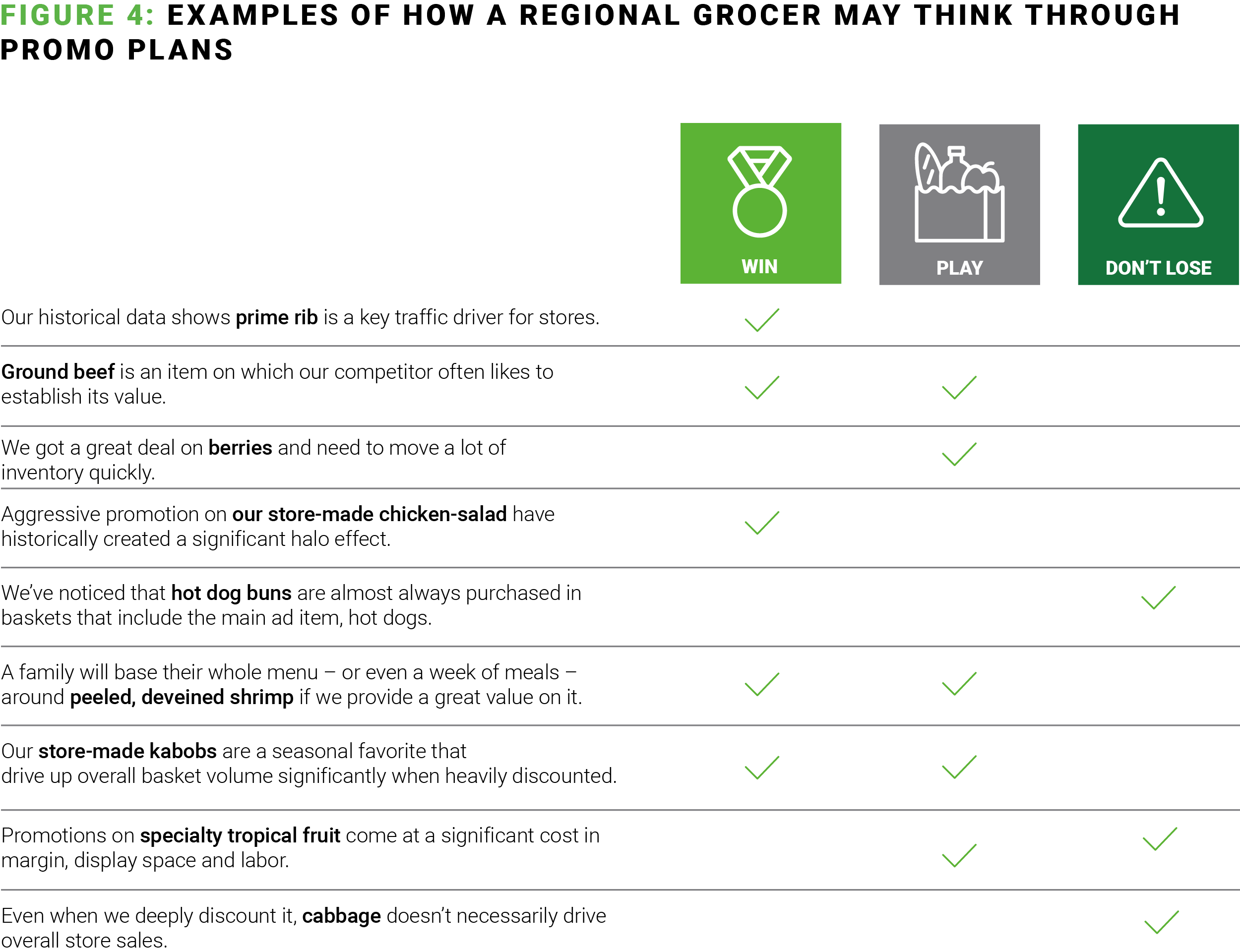

We recommend considering a “Win/Play/Don’t Lose” approach to pricing.

Retailers should review their historical data to develop a more complete understanding of which items they actually need to “win.”

Strawberries around Mother’s Day could be an example. Likely there have been some years in which a grocer’s strawberry prices were unbeatable and some years in which the price was in line with the market.

In examining how its stores performed overall on those occasions in different years, a retailer can determine whether the ultra-low strawberry prices correlated with meaningful increases in transactions, basket size and sales.

If so, a “win” promotional price would be warranted. If not, shoppers likely found sufficient value even in the years the strawberry prices were merely competitive.

This strategy helps grocers maintain margin by offering their deepest discounts (“win” prices) only on the items that matter most to their customers. Category managers will be able to help make these determinations.

3. Aim for basket value over item value.

Most customers have a primary store specifically because they believe the overall value across their shop is what matters most–not that they get the best price in the market on every item every time.

With that in mind, retailers should consider how to structure their advertising around meals rather than individual items. Instead of investing in promoting down to a “win” price on blueberries, for instance, a grocer might opt for a “play” price and pair it with discounts on pancake mix, butter or syrup. The key is communicating the overall value across marketing channels and then merchandising so shoppers can easily locate and purchase all the items included.

These types of meal solutions matter now more than ever. According to IRI, the share of meals prepared at home remains higher than in the past, at nearly 80%, driven in part by the fact that nearly 50% of people with jobs work from home at least once a week. In addition, inflation makes it likely that depressed restaurant engagement will continue.

Considering how primary, secondary and tertiary ad items influence overall basket size can help determine whether a retailer should go for a “win” promotional price or if a less aggressive price will suffice.

When to go for the “win”

Evaluation of past promotions is a great way to confirm–or disprove–traditional wisdom on how different items should be classified.

The following is a simple framework to examine promotion performance. Sales lift on a given ad item is one part of the story. Taking more factors into account will lead to smarter planning and more profitable promotions.

Keeping it fresh

Our survey data shows that traditional fresh promotions come up short for all involved. They’re not especially compelling to shoppers, who base their store choice on other factors. They’re not working for retailers, who need to maximize their resources by investing in areas of the business that have a greater influence on store choice.

Retailers must avoid falling into the trap of doing what they’ve always done, repeating the same promotions year after year. Market conditions change, competitive landscapes change, consumer expectations change, and strategies must change as well.

__________________________________________________________________________

Want more? Check out these other recent insights from the grocery experts at AlixPartners.

The $100 billion opportunity for U.S. grocers

The grocery industry is ready to get back to basics … but there’s debate over what that means