Flexibility and agility during unpredictable and disruptive times are becoming critical business characteristics in the modern world. Few market dynamics remain metronomically predictable, and sudden shifts in industry trends are requiring organisations to continuously evaluate their portfolios and reconsider its shape in order to best align and harness the opportunities presented.

Flow control is one such sector which is experiencing a multitude of change. Consisting of products such as pumps, valves, compressors, and meters, it is a segment that already plays a critical role in supporting the developed – and developing – world’s infrastructure needs.

The sector is currently underpinned by several macro influences and is being accelerated by favourable secular trends which is driving future growth potential for the industry. Some of the most notable drivers include:

Global infrastructure investment

The global infrastructure construction market size was $4.6 trillion in 2021 and is expected to grow at a CAGR of more than 2% between 2022-2026. This will create sizeable growth opportunities across a range of end markets that require flow control applications and technology. For example, the global water and wastewater treatment market – a key segment for flow control-related products – is expected to grow at 7.1% CAGR over the next seven years.

The energy transition to renewables

The shifting energy landscape is driving investment in the short term, for cleaner fossil fuels such as LNG, and in the medium to long term, for renewable sources such as hydrogen. In order to achieve the world’s 1.5-degree climate target by 2050, global investment of $150 trillion is required – of which $103 trillion is already planned. Flow control technologies are essential in renewables infrastructure; therefore, the industry is likely to benefit from significant growth as expenditure on renewable infrastructure increases.

Accelerated urbanisation in developing countries

The continued rapid urbanisation of developing countries is expected to reach 4.8 billion people by 2030 – an increase of 1.3 billion from today – and will require significant infrastructure investment to match it. This investment will be required across areas including gas networks, water treatment facilities and chemical plants, all of which are reliant on flow control products. As a result, developing economies are expected to be a strong engine for growth across the flow control market in the medium term.

Technological disruptions

The continuing emergence of Industry 4.0 and Industrial Internet of Things (IIoT) brings new opportunities for businesses to optimize their processes, drive operational and performance efficiencies and ultimately, improve cost and margin control. It will also increase demand for sensors and other flow control technologies to support new product development opportunities and solutions, such as predictive maintenance, data capture and monitoring, which will enable businesses to develop additional revenue streams and empower customers to make improved, and more timely decisions. The scale of this opportunity is evident from market sentiment surrounding IIoT with reports indicating that the worldwide IIoT market size is expected to grow by c.23% per year, from $216 billion in 2020 to $600 billion by 2025.

Outperformance in the industrials sector

The flow control sector has been consistently outperforming the broader Industrials sector since Jun-22. As evident in Chart 1, on a rebased basis as at Jan-22, our basket of flow control publicly traded stocks has outperformed the broader Industrials sector and public market indices (S&P 500 and FTSE 100). Whilst the widespread uncertainty due to the Ukraine war, rising inflation and recessionary fears impacted public markets in 2022, flow control stocks have, in comparison, fared well and are currently

up 6% on Jan-22, whilst the broader Industrials sector is down 5%, S&P 500 is down 9% and FTSE 100 is up 2%.

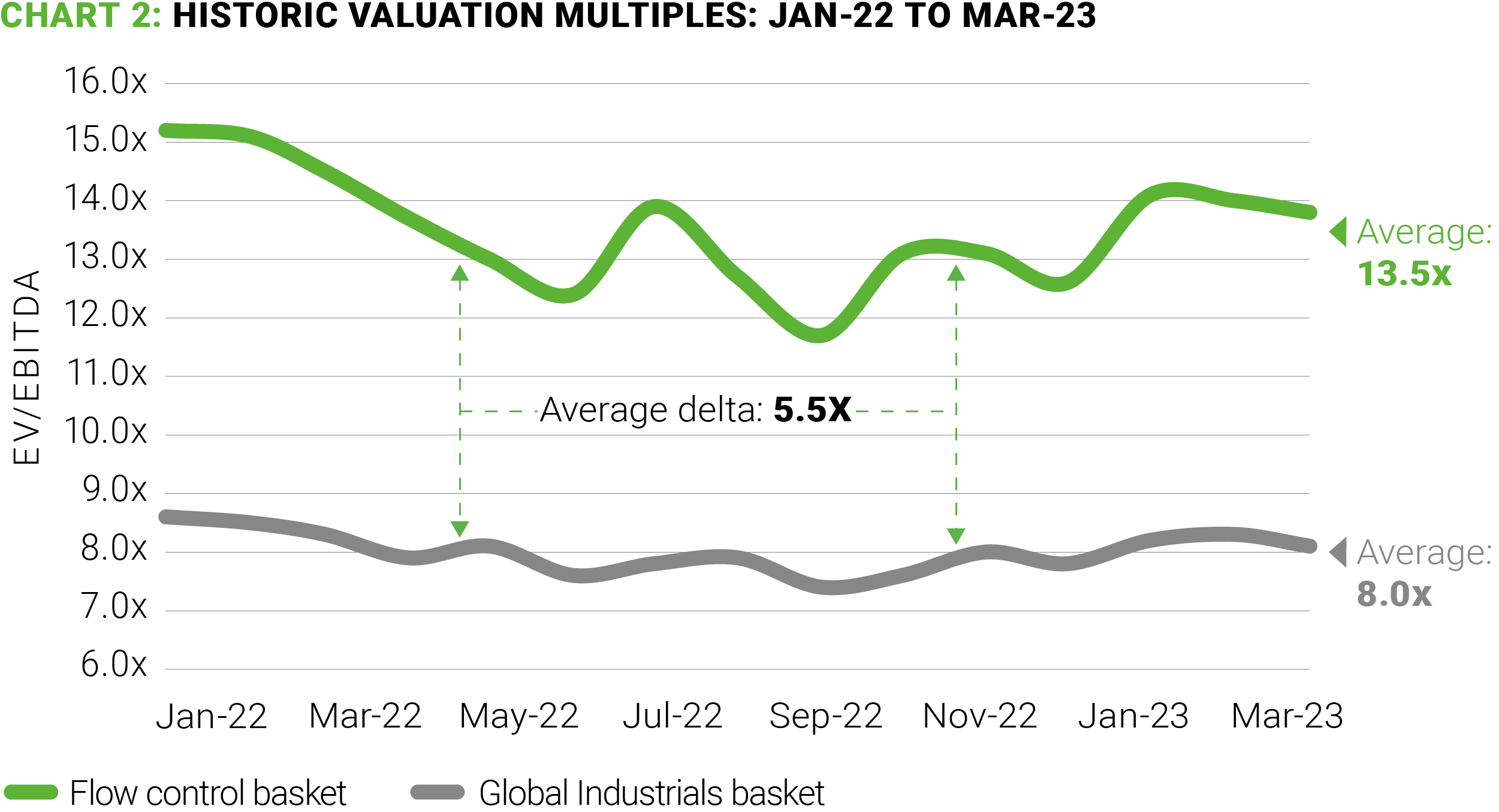

Furthermore, a review of historic valuation multiples demonstrates that flow control stocks are generally considered more valuable when compared to the broader Industrials sector, typically trading between 12x and 14x over the last 15 months, a delta of over 5x against the broader Industrials sector (see Chart 2).

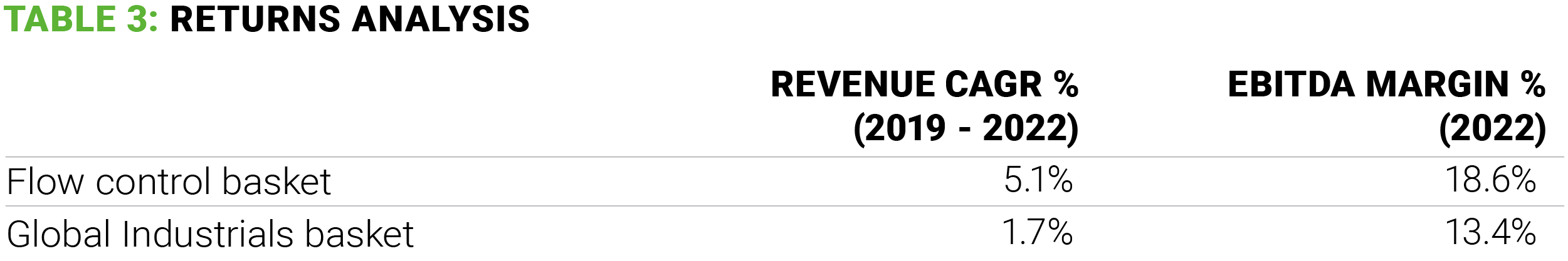

This is supported by the fact that flow control players have, simply put, performed better during what has been a challenging few years for businesses. Per Table 3, average 3-year revenue CAGRs for flow control companies is c.5.1%; the sector has not only withstood the challenging trading environment in the last three years but has also generated growth on pre-Covid performance. The broader Industrials sector, however, has not performed as well, achieving an average 3-year revenue CAGR of 1.7%. The higher trading multiples is also supported by the fact that flow control companies typically generate higher EBITDA margins (2022 average: 18.6%) compared to the broader Industrial companies (2022: 13.4%).

M&A will be key to harnessing growth opportunities

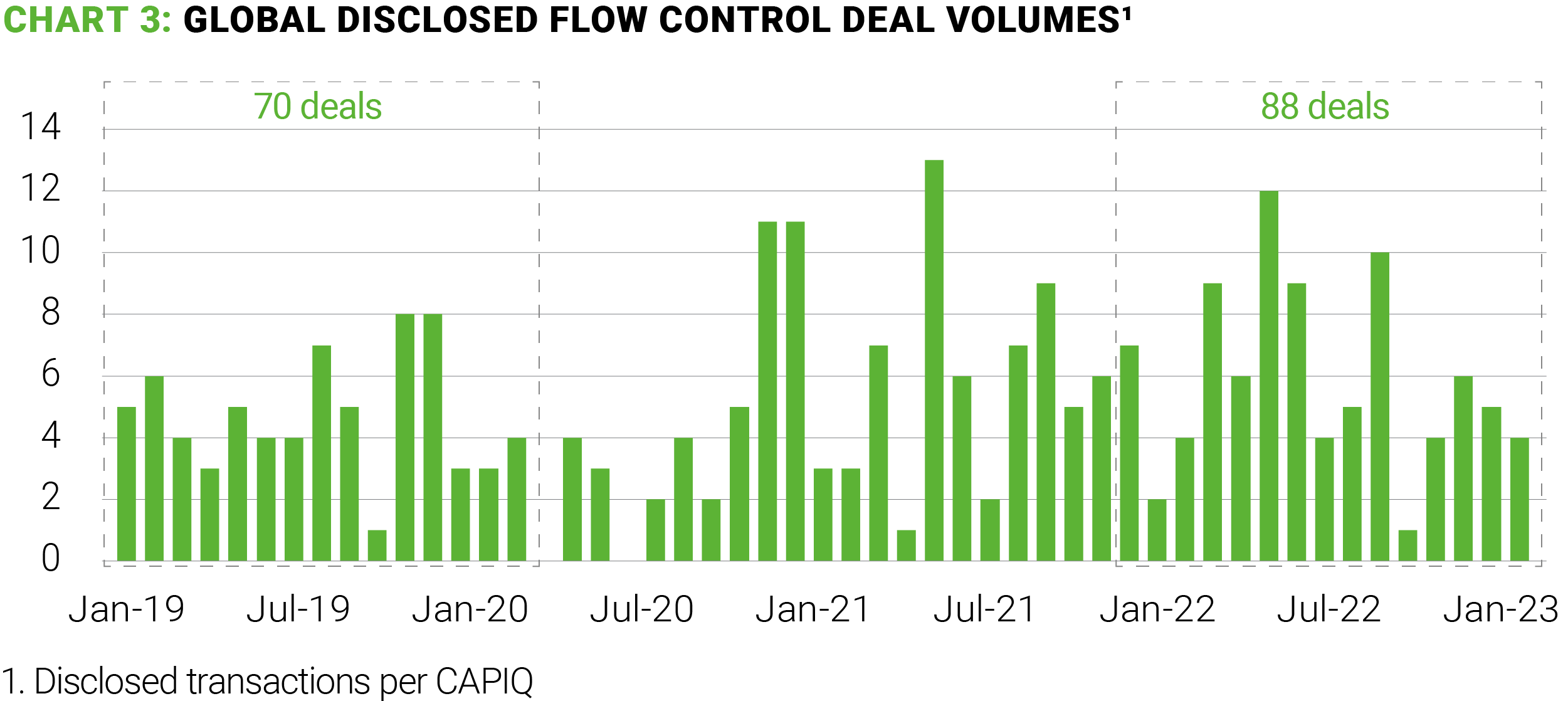

Whilst the last 6-12 months has been challenging from an M&A perspective, including the Industrial sector, deal activity in the flow control space remains strong. As evident on Chart 3, the total flow control deal volumes for the 15-month period from Jan-22 to Mar-23 (88 deals) is up 26% on the 70 deals during the same length period pre Covid (Jan-19 to Mar-20) which clearly demonstrates the continued, if not increased, appetite for flow control assets.

Against the backdrop of strong end market growth and continued technological development and disruption changing the operating landscape, M&A will be key for industry players to ensure they stay at the forefront of the market, are ready to ride the next wave of growth and are able to mobilise activity in adjacent areas where opportunities present themselves.

This can already be seen through Ingersoll Rand’s publicly announced M&A strategy, which is centred around the key themes of sustainable end-market exposure, accretive digital capabilities, and high aftermarket/recurring revenue streams.

Its acquisition of Seepex for €432m demonstrates this strategy in action, helping advance its digital and aftermarket capabilities through Seepex’s strong IP offering, which includes its own internally developed IIoT platform.

Other large corporates are also leveraging similar strategies. For example, in December 2021, Dover Corporation announced two acquisitions (Acme Cryogenics for $295m and Engineered Controls International for $631m) to enhance its clean energy solutions across both hydrogen and LNG.

As large flow control players prepare for and begin to respond to the changing market environment, businesses with compelling digital capabilities and exposure to fast growing end markets will remain in high – if not higher – demand, leading to very strong valuations.

We also expect these large players to increasingly review their portfolios to identify and in turn carve out non-core divisions that are not aligned with growth segments, providing openings for carve-out-orientated private equity firms and corporates looking for consolidation opportunities. Given the fragmented nature of the sector, it is also a good hunting ground for private equity and we expect private equity interest to remain high.

Note: (a) No flow control sector deals in Q1 2022 have published EV/EBITDA multiples. (b) 2022 YTD includes January to April 2022.

Sources: Global Data, Fortune Business Insights, IRENA World Energy Transitions Outlook 2023, Grand View Research