The global engineering and construction industry notched a strong performance in recent years, with continued post-pandemic recovery reflected in broad revenue growth across all sectors and geographies. While the overall outlook is favorable, the economic backdrop remains murky and several industry-specific challenges need to be considered.

Government support programs such as the U.S. Infrastructure Investment and Jobs Act; the Inflation Reduction Act (IRA); and the CHIPs Act drive positive sentiment. These will:

- Fund investments in civil construction, water infrastructure, affordable housing, mass transit, and technology infrastructure.

- Address climate change and energy affordability/security via investments in electrification, grid resiliency, storage, renewables, and EV infrastructure.

- Support national security programs and military infrastructure, in part driven by the war in Ukraine.

Poised for disruption?

This optimism, however, must be measured.

A new survey conducted by AlixPartners shows that executives are approaching the future with their eyes wide open. While many executives expect modest revenue increases and profit growth in the near-term, they believe disruption may be lurking around the corner for the engineering and construction (E&C) sector. Inflation, potential construction slowdowns, and other macroeconomic factors weigh heavily on leaders in this industry.

Recently, we polled more than 200 senior executives running E&C companies in the U.S., Europe, and the Middle East with revenues exceeding $100 million. AlixPartners wanted to better understand the economic outlook and market expectation in the E&C sector.

We conducted this survey knowing disruption is top of mind for senior leaders, regardless of the sector in which they operate. The most recent AlixPartners Disruption Index, for instance, found that nearly 9 in 10 chief executives feel it is as difficult as ever to know what to prioritize as they address this central business dilemma. Now in its fourth year, the 2023 Disruption Index showed 75% of CEOs say their companies are not adapting fast enough; 98% say they expect their business models to change within three years; and 82% expect a near-term recession to add further pressure.

Interest rates, inflation, continued fallout from the pandemic, and supply-chain kinks are all key issues keeping these executives up at night.

Similar headwinds are driving concerns for E&C executives. Cost increases for materials, labor-rate hikes, and currency volatility all represent pain points and major threats to the industry's post-COVID-19 recovery. Potential slowdowns in commercial and residential building construction also pose significant threats.

Building on a strong foundation

Concerns about the future should be buttressed by the fact that E&C firms enjoy a strong foundation. Revenue grew more than 10% in 2022 compared to the previous year. This increase boosted all E&C sectors as the industry—particularly those with a strong presence in North America—fortified its continued recovery from the COVID-19 downturn. Those with stronger European and APAC businesses, meanwhile, faced headwinds.

Fortune doesn’t necessarily favor the industry's biggest players. Large companies (with more than $16 billion in annual revenue) grew modestly at 2 to 3% compound annual growth rate (CAGR) over the past five years, while smaller companies (<$5B) have grown the fastest at 10 to 12% CAGR. Profitability—as measured by EBITDA—followed similar trends with overall sector margins expanding by 1 to 2% over the past five years. Profit growth was again led by smaller companies.

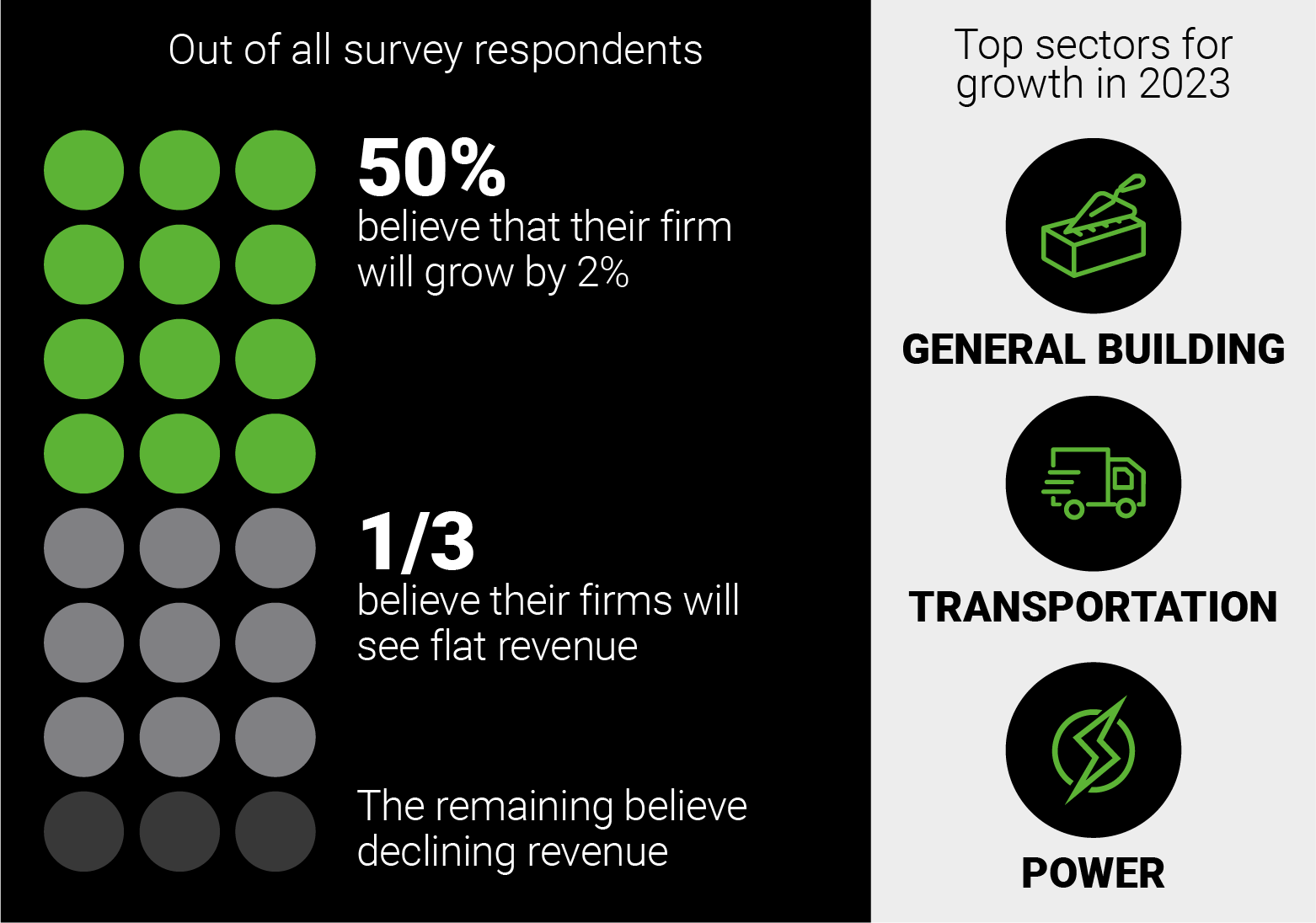

The AlixPartners 2023 E&C survey found approximately 50% of respondents believe their firms will grow by more than 2%. One-third, however, believe their firms will see flat revenue. The remainder see declining revenue. General building, transportation, and power are believed to represent the top sectors for growth in 2023, particularly those companies experiencing a tailwind from the Biden administration’s infrastructure spending plans.

Firms were somewhat more bullish on backlog expectations, with two-thirds expecting increasing backlog and the rest expecting flat-to-declining backlog. Reducing backlog is a positive development if the pullback leads to narrower focus on core segments that offer margin growth.

Margin expectations, in fact, somewhat echo revenue outlook. About half of firms surveyed expect profit growth, with the other half forecasting flat-to-slightly-declining profitability in 2023.

Stability amid disruption

Many E&C companies seem to recognize the challenges in store. Those planning for these disruptions are considering the following actions as they craft their plans to be sturdy enough to weather the storm:

- Focusing on core and organic growth opportunities, while the pursuit of inorganic growth becomes a low priority. This requires selective bidding to ensure projects are in line with internal competences.

- Prioritizing core markets and managing risks appropriately, and placing increased emphasis on reimbursable contracts over fixed price/unit contracts.

- Reducing cost structures to maintain competitiveness and profitability, particularly in light of rising wages and other costs.

- Continued development of new tools and internal capabilities, leveraging digital tools and technologies designed to streamline work processes, lower costs, and improve project outcomes.

- Focusing on next generation technologies such as biometric security, augmented/virtual reality, automation, building information modeling/digital twin technology, 3D printing, collaboration, and blockchain to improve project outcomes.

- Beefing up internal ESG initiatives, including net zero emissions, zero waste, and continued focus on safety. An overwhelming number of respondents believe ESG concerns will drive integration of sustainable technologies into project designs; new project profiles and skill requirements; implementation of carbon reduction technologies; and proliferation of new/updated building and construction standards.

- Enhancing employee programs to improve recruiting, retention, and diversity.

While no company is immune to destabilizing forces that reshape the sector in which it operates, all should be prepared to demonstrate resilience. This is only possible with a blueprint that considers an array of potential disruptions; identifies a dedicated team to implement a meaningful strategy to respond; and an eyes-wide-open response that is mindful of opportunities even while navigating the risks.

Moving from problem-finding to problem-solving

Time and again, we’ve seen that the winners from disruption in any industry are those with a bias for action, moving quickly from analysis to execution. They focus on solving business problems with a measurable ROI and maintaining pace over perfection.

AlixPartners employs tools to analyze project profitability and creates initiatives to improve project outcomes. We work with clients to identify and align on core capabilities and restructuring goals, and then find specific solutions—for example, developing a digital twin of supply chains to help navigate inflationary market conditions and mitigate the impact of commodity price fluctuations.

Working across several industries that E&C firms support, we not only identify problems and create plans, but then partner with the firms to execute.