Contractors must now accelerate profitable growth

Although the defense industry’s pool of economic profit (EP)[1] experienced a sharp decline in 2022 and only a partial recovery through three quarters of 2023 results, investors are still bullish on the sector and expect strong medium- to long-term profit growth.

2022 was a rough year for defense profitability, as the industry experienced a 40% EP decline vs. 2021. The performance reversed the steady 3% EP CAGR recorded in the five years through 2021. With three quarters of 2023 in the books, analyst consensus estimates are for the full year 2023 profit pool to increase 30% vs. 2022, but remain 15% below the 2021 level.

Large prime contractors’ topline performance contributed to the 2022 profit pool decline, as the industry struggled to meet delivery schedules amid continued COVID-related supply chain challenges. The top 5 prime contractors[2] also weathered a 3% topline decline in 2022 vs. 2021, contrasting with 5% growth in 2021 vs. 2020. After three quarters of 2023 results, consensus estimates are for the top 5 prime contractors to increase revenue by 1-2% in full year 2023 vs. 2022 – an improvement, but well below historical growth levels.

Program execution challenges (addressed in a recent piece titled “Back to basics on program management”) eroded margins, also contributing to the profit pool decline. Industry EP margins dropped 400 bps in 2022, with negative estimate at completion (EAC) contributing to the margin decline. These program execution challenges have persisted into 2023 as 4 of the top 5 prime contractors reported net negative EAC adjustments (as a percentage of operating income) in the first 9 months of 2023.

2024 expectations strong despite tough 2022 and 2023

Defense still performed well in the capital markets despite the recent profit challenges, with defense stocks generating a 10% total shareholder return (TSR) vs. an S&P 500 decline of 5% since the beginning of 2022[3]. This suggests investors expect a recovery in defense profitability, profit growth, and strong cash flow going forward. Several reasons to expect sustained topline momentum include: ongoing conflicts in Ukraine and the Middle East; rising tensions in the Pacific; increased investment in space and cyber capabilities; and a continued shift from legacy to next-generation programs. Analyst consensus calls for 5% revenue CAGR from 2022-2026, with international contractors expected to realize higher growth than the top 5 U.S. primes (7% CAGR vs. 4% CAGR, respectively), largely due to an expected increase in European defense budgets associated with the conflict in Ukraine. Recent developments in Israel may further accelerate growth expectations for international contractors. Additionally, growing concerns about the Pacific theater are likely to result in defense contractors in South Korea and Japan seeing higher growth.

The top 5 prime contractors still capture 70% of the defense profit pool despite declining performance in 2022.

These top 5 contactors are expected to lead the recovery, with analysts forecasting 350 bps EP margin improvement from the 2022 trough through 2026. Smaller U.S. contractors and international players are expected to generate significant but smaller EP margin improvement of 100-200 bps from 2022-2026. Overall, analysts expect the defense contractor profit pool to return to 2021 levels in 2025 and grow to $14B by 2026 (150% above 2022 and 15% above 2021).

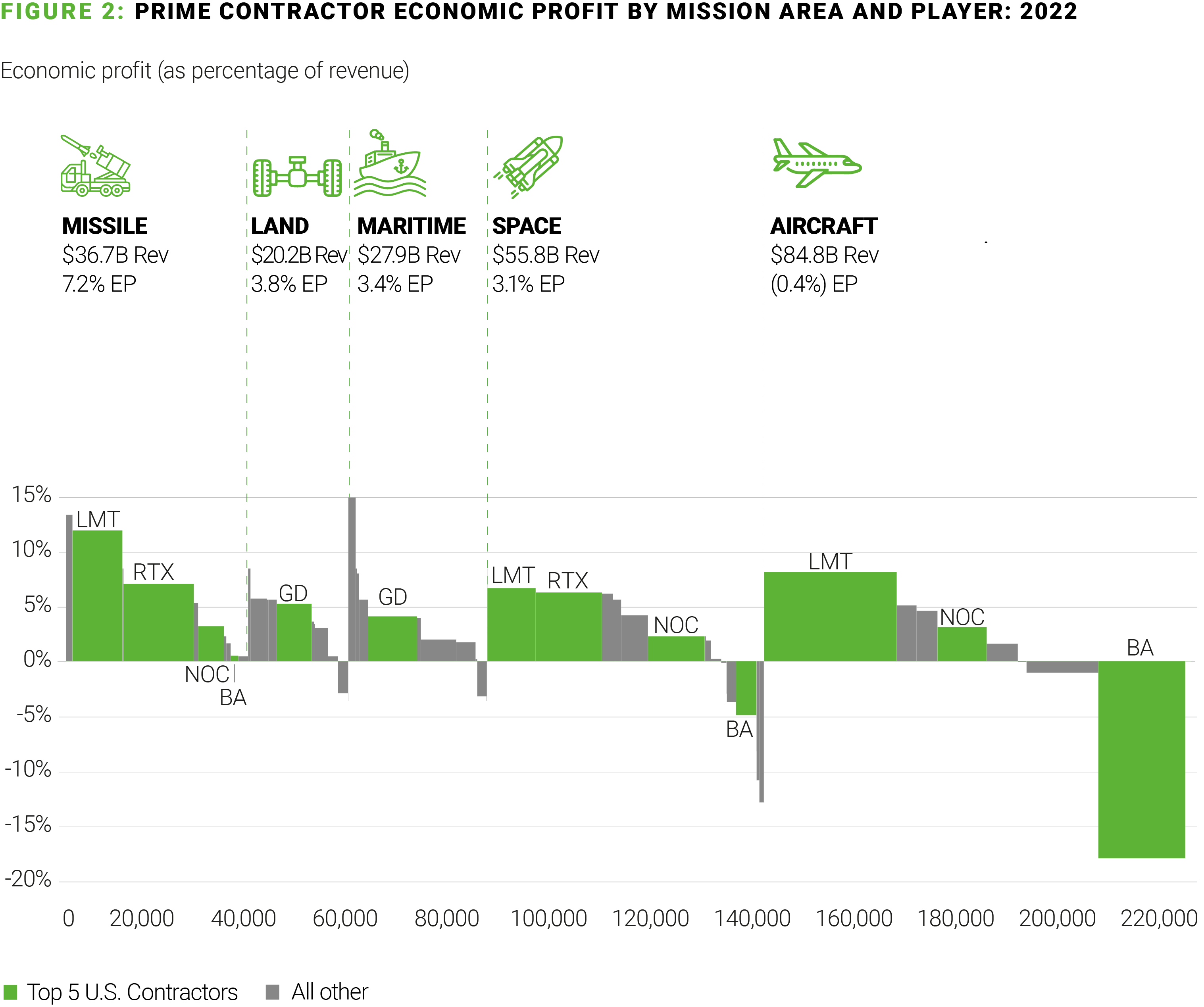

Where will growth come from? From a mission area perspective, space and missiles are expected to drive half of global contractor growth. In other mission areas, growth is forecasted to vary by region. In the U.S., aircraft, ground, and maritime are expected to deliver steady but below-market revenue growth. In Europe, ground and aircraft are forecasted to drive 70% of European contractor growth, owing to the war in Ukraine.

Operational discipline, investment required for sustained growth

To deliver on profit growth expectations, contractors must drive operational improvements and address recent supply chain disruption, inflation, and program management issues. While market growth is expected to provide opportunities to deliver on bullish expectations, contractors will not realize their full profit growth potential without addressing these recent challenges. In particular, driving near-term results hinges on improving operational execution.

Over the longer term, a shift in both Department of Defense (DoD) and international budget priorities requires companies to adjust their strategic focus and resource allocation.

Therefore, contractors are faced with two major questions:

- How can the defense industry overcome recent program execution challenges?

- How can business models adapt to a shifting market environment?

Improving program execution

Weak cost estimation is often the root cause of program execution mishaps. Starting with a poor baseline rarely leads to desirable results, forcing program managers to dig out of deep holes from day one.

To overcome this, cost estimation should adhere to a pyramid framework, with the base formed by engineering, operations, supply chain, and sustainment teams utilizing past or comparable experience to develop initial data. This is supported by documented and detailed basis of estimates. Finance experts can then develop a well-informed, factually grounded estimate for which they are accountable. Leadership is at the top of the pyramid, using a governance approach that forces technical teams to document the rationale behind assumptions and finance to provide a sense check.

If profitable growth and sustained cashflow is the goal, then a well-defined gate process should be established within this pyramid. Linking costs to specific profitability targets is essential. At every step, work with the customer – changing, vague, or unrealistic requirements must be kept in check as they represent potentially the biggest obstacles to success. Lock agreed-upon parameters as early as possible. One of the industry’s biggest challenges is to develop a new generation of program managers who lead and drive their programs as CEOs. Implementing these disciplines from the top–down is a key way to build these capabilities.

Building resilience

Rapid-response capabilities, including cross-functional teams, tools, and processes, need to be in place from the start of a program and be poised for rapid deployment to help identify and resolve the root causes of emerging variances. Additionally, defense firms should periodically perform stress tests across each phase of the product lifecycle. Consider several areas – from work breakdown structures to risk registers to contract management – where companies can assess the likelihood of negative program performance. Stress tests can identify vulnerabilities early and raise the likelihood of recovery.

Strategic positioning in a dynamic market

To deliver medium- to long-term growth, contractors must align their capabilities and program portfolios with DoD’s long-term budget priorities. Recent signals indicate that space and missiles are ongoing priorities, likely to offer the most potential over the coming three to five years. For those with an advantaged presence in these mission areas, there is a clear opportunity to invest in expanding existing capabilities and driving increased focus and resources.

The road is more challenging for those without a differentiated presence in these strategic mission areas. M&A is one potential avenue; however, it presents an increasingly challenging path to value creation amid a sparse selection of targets and increasingly expensive valuations. To create value through M&A, rigid pre-deal diligence, post-close synergy capture, and integration are critical disciplines. For many, partnerships and joint ventures may be more accessible avenues for growth.

Another requirement for sustained profitable growth is an awareness of what to avoid – entanglement in long-term, chronically unprofitable programs. In pursuit of topline wins, defense contractors often overestimate what they can deliver from a cost and schedule standpoint. Aggressive bids are increasingly costly in an industry shifting toward fixed-price contracts. A single miscalculated program can haunt a contractor for multiple quarters or even years down the road. Tighter alignment of business development and R&D investment, with a clear-eyed view of profit potential, is essential. Sometimes, a “No Bid” is the winning approach.

Focused efforts are key

Despite profit challenges, defense players have outperformed the broader capital market since the beginning of 2022, reflecting a strong investor long-term outlook.

Contractors must now take action to accelerate profit growth and meet these high expectations.

Improving program management, collaborating with supply chains to extract more value, and rationalizing over-extended industrial footprints are clear and pressing near-term priorities for the industry to improve its margins and will be critical to driving near-term results. Delivering long-term success requires aligning focus and resources to DoD budget priorities, which will drive future market profit pools.

FOR A DEEPER DISCUSSION ON THIS TOPIC, CONTACT:

Eric Bernardini

Global Lead, Aerospace, Defense, and Airlines

[email protected]

David Wireman

Partner & Managing Director

[email protected]

Joe Shalleck

Partner & Managing Director

[email protected]

[1] Economic profit (EP) is after-tax operating profit less a charge for capital employed

[2] Top 5 Prime Contractors include Boeing, General Dynamics, Lockheed Martin, Northrop Grumman, RTX

[3] Represents annualized total shareholder return from January 2022 through October 2023