Instacart’s interests aren’t aligned with the interests of grocers when it comes to trade spending. The company’s prospectus shows that Instacart’s most significant new revenue stream comes from the same pool of money its retail partners have been counting on tapping as they launch their own media networks. Instacart intends to continue growing its share of the digital marketing dollar going forward, and PepsiCo’s $175 million private placement signals the interest is mutual. This news should make grocers think twice about their status with advertisers and adjust their investments accordingly.

The core business is still the core business

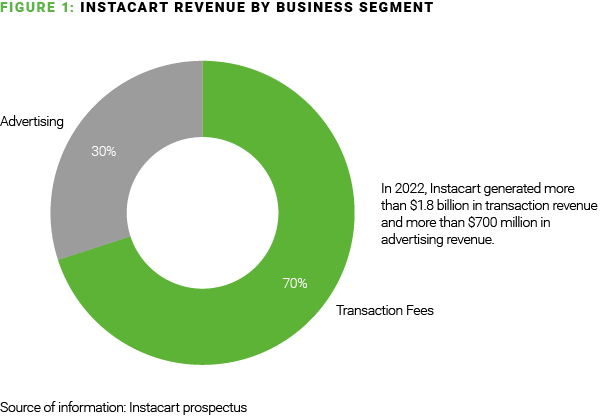

Since 2019, Instacart has invested heavily in advertising, building an impressive $700 million ad business in short order. Yet advertising’s contribution to their overall revenue has been steady at 30% across 2021, 2022 and the first six months of 2023. It’s certainly a meaningful amount, but the lack of growth suggests the ad opportunity may have reached a natural upper bound. The slowdown isn’t surprising, given that once all the major brands have come on board, gains depend on convincing existing advertisers to spend more.

An average Instacart order of $110 generates $10 of total revenue. While three of those dollars come from advertising, the other seven come from the fees Instacart collects from its retail partners and customers (Figure 1). Fees aren’t sexy, but they remain the foundation of Instacart’s model.

Grocers contemplating their own retail media strategy should study the details of Instacart’s ad business that are disclosed in the prospectus, including their monthly active users, the average incremental sales lift of their ads, the number of items sold each quarter, and the ease of managing ad campaigns. Most grocers won’t be able to compete in every area, but they can gain valuable perspective on how their network will measure up and what they might reasonably expect it to contribute to the overall business.

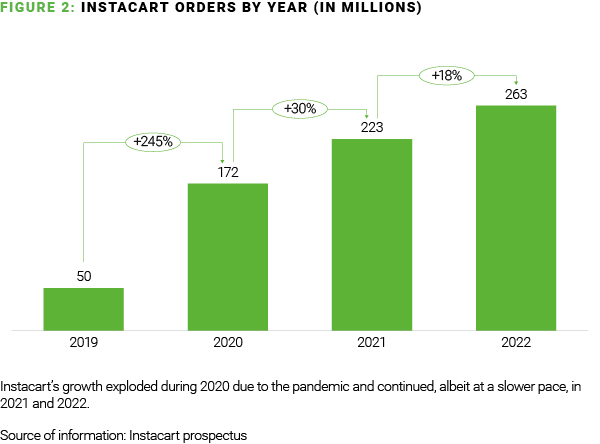

No scale, no sale

Many grocers jumped onto the retail media bandwagon with dollar signs in their eyes, but not all networks are created equal. There will be winners and losers – and perhaps consolidation – in the years ahead. Instacart, while it identifies as a retail support company rather than a retailer, will almost certainly be a winner. More than 1,400 national, regional and local grocers across more than 80,000 stores partner with the company, representing 85% of U.S. grocery, according to its prospectus. Instacart fulfilled 262.6 million orders in 2022 (Figure 2). That’s the bang for the buck that advertisers want.

Large multi-banner chains can leverage their own vast consumer data to present relevant offerings to CPG brands and compete with Instacart for digital spend, but smaller regional players will need to get creative. They must design a differentiated and exceedingly valuable experience for advertisers, or they should explore how to band together with other retailers to create the scale they lack alone.

Meet the new money, same as the old money

In its prospectus, Instacart cites a 2022 report that 82% of brands surveyed planned to invest more in advertising on retail media networks while maintaining their existing trade spending. Large CPGs do have extravagant marketing budgets, but they aren’t unlimited. The realistic expectation is that retail media spending will cannibalize traditional trade spending. That shift is likely happening already.

A 2023 study by the Association of National Advertisers shows that 28% of brands currently see participation in retail media networks as a cost of doing business rather than a valuable tool. In addition, the complexity of running ad campaigns across a slew of networks with different requirements and reporting practices is prohibitive, even for large CPGs.

For those reasons, most grocers are unlikely to benefit from transformative shifts in ad spending by CPGs. Grocers should be wary of brands beginning to shift away from in-store trade spending, where return on investment can be more difficult to measure. As soon as possible, grocers that don’t already have an ironclad understanding of how trade funding affects their profitability for different categories and items need to close that knowledge gap, and they need to prepare to advocate for brands to spend in the areas grocers know move the needle for their business.

Instacart with the edge

Instacart’s high average order value ($110) means that it frequently captures weekly shops and stock-ups – the same high-profit trips most prized by grocers. The company also boasts impressive retention numbers. Instacart has 7.7 million monthly active orderers, many of whom have been using its service for years. Its 2017 and 2018 customer cohorts – those users who placed their first Instacart orders in 2017 and 2018, respectively – spend increasingly more with the company every year (Figure 3), with the prospectus showing steady value generated from those groups as recently as the first two quarters of 2023. The company has even retained most of the value of the pandemic-era cohorts of 2020 and 2021. It's all good news for Instacart, but it’s not so rosy for regional grocers who won’t have the scale to compete in retail media and whose most valuable trips Instacart continues to pursue.

Grocers should expect Instacart’s ad business to impact their own initiatives similarly to how it has in recent years. It will continue to compete for the same dollars that grocers with retail media networks are trying to win, and in most cases, it will continue to have an advantage.

_________________________________________________________________

Want more? Check out these other recent insights from the grocery experts at AlixPartners:

Assess before you invest: Why a data deep dive must be the first step for grocers exploring AI

Three ways grocery retailers can promote more profitably in fresh